August 08, 2024

With all eyes and ears still focused on clues to when the Federal Reserve (Fed) will begin to cut interest rates, notable data releases in July boosted expectations that a rate cut is coming in September which created significant turbulence in financial markets that set off what is being dubbed the great rotation. Equity market leadership shifted to small-capitalization (cap) stocks and away from mega-cap technology and communication sector stocks related to the artificial intelligence (AI) frenzy, bond yields dropped sharply, and commodity prices fell with the exception of gold, often seen as a safe haven asset.

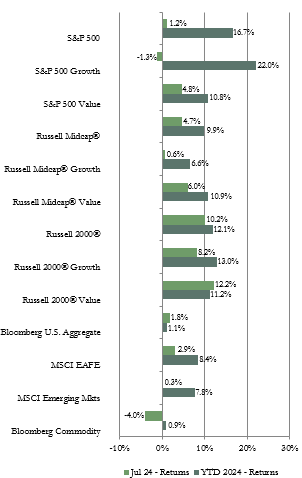

Market Indices – July 2024

The Nasdaq and S&P 500 indices continued the trend from June and marched higher to set more new record highs early in the month. These gains were made despite the surprisingly weak purchasing manager survey reports and labor market data. The Institute for Supply Management’s index of manufacturing activity dropped to 48.5, the lowest level since February and the services index fell into contraction territory at 48.8, which was the lowest reading since early 2020 in the pandemic. The labor market continued to show signs of slowing with the unemployment rate ticking up to 4.1%, the highest since November 2021. Then the consumer price index (CPI) report came out showing the first negative CPI monthly growth rate since early 2020. The CPI fell -0.1% in June compared to May. The annual growth rate dropped to 3.0%. The signs of a cooling economy along with cooling inflation bolstered confidence that the Fed will cut its policy interest rate in September and possibly in December also. The prospect of lower interest rates fueled a rally in small-caps and previously out of favor cyclical and interest rate sensitive sectors and a sell-off in the prior market leaders such as AI related technology stocks, including the Magnificent 7. This rotation was further boosted by dovish comments on inflation and monetary policy by Fed Chair Powell. The technology sector around the world was also pressured by China focused trade curbs issued by the White House and by disappointing earnings announcements from companies including Alphabet and Tesla.

The Nasdaq and S&P 500 indices continued the trend from June and marched higher to set more new record highs early in the month. These gains were made despite the surprisingly weak purchasing manager survey reports and labor market data. The Institute for Supply Management’s index of manufacturing activity dropped to 48.5, the lowest level since February and the services index fell into contraction territory at 48.8, which was the lowest reading since early 2020 in the pandemic. The labor market continued to show signs of slowing with the unemployment rate ticking up to 4.1%, the highest since November 2021. Then the consumer price index (CPI) report came out showing the first negative CPI monthly growth rate since early 2020. The CPI fell -0.1% in June compared to May. The annual growth rate dropped to 3.0%. The signs of a cooling economy along with cooling inflation bolstered confidence that the Fed will cut its policy interest rate in September and possibly in December also. The prospect of lower interest rates fueled a rally in small-caps and previously out of favor cyclical and interest rate sensitive sectors and a sell-off in the prior market leaders such as AI related technology stocks, including the Magnificent 7. This rotation was further boosted by dovish comments on inflation and monetary policy by Fed Chair Powell. The technology sector around the world was also pressured by China focused trade curbs issued by the White House and by disappointing earnings announcements from companies including Alphabet and Tesla.

After the dominance of a few mega-sized technology and communications stocks for several months, the Russell 2000 index of small-cap stocks outperformed the other major U.S. equity indices by a wide margin in July. The Russell 2000 posted a return of 10% compared to a return of just under 5% for the mid-cap index and a return of just over 1% for the S&P 500. Value indices outperformed growth indices in each market cap category. Because of investors’ rotation away from prior performance leaders, the tech sector was the worst performing sector in the mid and small-cap indices and the second weakest performer in the S&P 500 after the communications sector while the more interest rate sensitive real estate, financials, and utilities sectors were the top performers in each market cap segment.

In foreign equity markets, the MSCI EAFE index of developed international equities posted a positive return which outperformed the S&P 500 index on a U.S. dollar basis. The return for the EAFE index was significantly lower on a local currency basis since the dollar depreciated against the euro, pound, and yen during much of the month. While still positive, the local currency based EAFE return lagged the return for the S&P 500. The EAFE index outperformed the MSCI Emerging Markets index (EM) which had a return of less than 1% on both a U.S. dollar and local currency basis. Currency impacts were less significant for the EM index returns. Value stocks outperformed growth in both indices since the technology sector with a negative return was the weakest performing sector in both indices. Utilities had the top return in the EAFE index while healthcare had the best return in the EM index. On a geographical basis, among developed international markets, most country indices posted a positive return with Ireland and Japan posting the top returns. The main index in Japan hit a new all-time high mid-month before retreating on yen strength and tighter U.S. restrictions on exporters of semiconductors to China. In emerging markets, returns were more mixed. Countries including Greece, Egypt, and Thailand had strong positive returns while others including China, Korea, and Taiwan had negative returns. China continues to be hurt by weakness in the consumer sector while Korea and Taiwan were hurt by the sell-off in semiconductor and other AI related technology stocks.

U.S. bond market sector returns were positive for July. Yields moved down across the yield curve in reaction to data pointing to slowing inflation and a weakening labor market which boosted optimism for an interest rate cut by the Fed. The yield changes were significant with Treasury bill and bond yields reaching five-month lows. The 2-year Treasury bond yield moved down to 4.3% at the end of July and the 10-year Treasury yield ended July at 4.1%. This compares to yields of 4.7% and 4.4% respectively at the end of June. In the declining yield environment, longer time to maturity bonds had the largest returns.

The Bloomberg Commodity index had a negative return for the month. Each of the sub-indices we track except precious metals and livestock recorded a negative return. The precious metals sub-index was boosted by the sharp hike in the price of gold which rose as confidence increased that the Fed will cut the fed funds rate in September. In fact, gold hit a new all-time high during the month. The energy and industrial metals sub-indices led on the downside due to worries about weakening demand especially from China as that economy continues to slow.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Signs are increasing that the economy is slowing as the cumulative impact of high inflation and high interest rates continues to be felt by consumers and businesses. Manufacturing, housing activity, and vehicle sales are weak. Multiple companies described softening consumer demand and increasing price consciousness in quarterly earnings reports. The number of job quitters has fallen dramatically back to pre-pandemic levels and the unemployment rate is ticking higher each month. Manufacturing is weak outside the U.S. as well and China’s property sector woes continue to pressure consumer confidence and spending there. These factors are likely to pressure margins and corporate earnings. Expectations are high that relief is coming in the form of a Fed rate cut during the third quarter. However, there is still uncertainty if rates will come down enough to spur consumer and business confidence and spending in the last part of this year and into next year. As investors look for clues to whether the economy is in a soft patch or if a recession is on the horizon, financial markets are likely to be volatile reacting to news and data reports.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: