September 06, 2024

Volatile was the word to describe financial market activity in August. At the beginning of the month, the jobs report showed only 114,000 jobs were added in July, the lowest monthly number since 2020, and the ISM Purchasing Managers’ index of manufacturing activity dropped further into contraction territory than expected with a reading of 46.8. This weaker than expected economic data came on top of the Bank of Japan hiking its key interest rate and a sharp rise in the value of the yen which abruptly made previously lucrative carry trades unprofitable. (In a carry trade investors borrowed at near zero interest rates in Japan and invested in higher yielding assets in the U.S. and other countries.) The combination of events set-off a global equity sell-off and a rally in bond markets in the first three trading days of the month. In the U.S.,  government bond yields dropped to the lowest level of the year (and prices rose). The Nasdaq index fell into a correction (down 10% from the July peak) and the S&P 500 index nearly also declined into correction territory. In Japan, the Nikkei index dropped over 12%, the biggest one-day drop since October 1987. However, markets rebounded as the month progressed on optimism for a soft landing in the U.S. Fed comments, better than expected economic data, and some strong corporate earnings reports sparked the rebound. Minutes from the July Federal Reserve meeting noted that a majority of members think it is appropriate to ease monetary policy at the September meeting and Chairman Powell commented at the Jackson Hole symposium that “the time has come for policy to adjust”. Consensus now expects a quarter percentage point reduction in the fed funds rate in September and December and possibly in November as well. Economic data released later in the month boosted confidence in the resilience of the U.S. economy despite continuing weakness in the manufacturing and housing sectors. For example, retail sales were up 4% over the prior month, which was stronger than expected, and inflation data showed progress toward the Fed’s goal. At 2.9% year over year growth, the consumer price index report came in under 3% for the first time since March 2021. Strong earnings reports from companies such as Walmart and Cisco Systems added fuel to the equity rally. The Dow Jones Industrial Average recovered to hit multiple new record highs late in the month and the S&P 500 came close to setting a new record.

government bond yields dropped to the lowest level of the year (and prices rose). The Nasdaq index fell into a correction (down 10% from the July peak) and the S&P 500 index nearly also declined into correction territory. In Japan, the Nikkei index dropped over 12%, the biggest one-day drop since October 1987. However, markets rebounded as the month progressed on optimism for a soft landing in the U.S. Fed comments, better than expected economic data, and some strong corporate earnings reports sparked the rebound. Minutes from the July Federal Reserve meeting noted that a majority of members think it is appropriate to ease monetary policy at the September meeting and Chairman Powell commented at the Jackson Hole symposium that “the time has come for policy to adjust”. Consensus now expects a quarter percentage point reduction in the fed funds rate in September and December and possibly in November as well. Economic data released later in the month boosted confidence in the resilience of the U.S. economy despite continuing weakness in the manufacturing and housing sectors. For example, retail sales were up 4% over the prior month, which was stronger than expected, and inflation data showed progress toward the Fed’s goal. At 2.9% year over year growth, the consumer price index report came in under 3% for the first time since March 2021. Strong earnings reports from companies such as Walmart and Cisco Systems added fuel to the equity rally. The Dow Jones Industrial Average recovered to hit multiple new record highs late in the month and the S&P 500 came close to setting a new record.

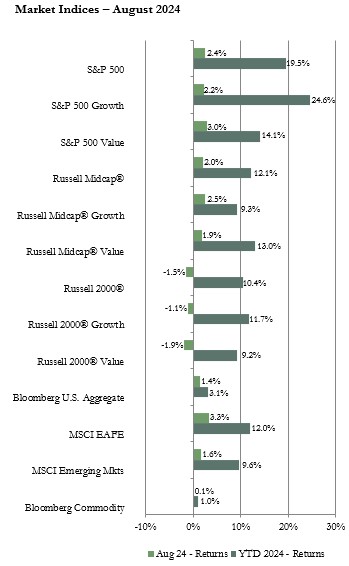

The S&P 500 index finished the month up 2.4% after being down 7% from the prior month-end at one point in the sell-off. In a noteworthy shift, the Magnificent 7 did not lead the index during the month. Instead, the defensive sectors outperformed on flight to safety trading. Consumer staples had the highest return among the 11 sectors in the index. In addition, as it became clear that the Federal Reserve is ready to cut rates, interest rate sensitive sectors rallied. For example, the real estate sector in the S&P 500 index gained 5.8% for the month. Therefore, the S&P 500 value index outperformed the S&P 500 growth index. The Russell Mid Cap index also rebounded to end the month with a gain, but the Russell 2000 index of smaller sized companies was not able to fully recover from the sell-off and ended the month down 1.5%. Sector performance in the mid and small-cap indices was different than in the S&P 500 index. Growth stocks outperformed value stocks in both the mid and small-cap indices with the communications sector posting the top return. The energy sector was a laggard in all three indices reflecting the weakening demand and increasing supply dynamics in the oil market.

In foreign equity markets, the MSCI EAFE index of developed international equities posted a 3.3% return which outperformed the S&P 500 index on a U.S. dollar basis. Just as in July, the return for the EAFE index was significantly lower on a local currency basis since the dollar depreciated against the euro, pound, and yen during much of the month. While still positive, the local currency based EAFE return lagged the return for the S&P 500. The EAFE index outperformed the MSCI Emerging Markets index (EM) which had a return of 1.6% on a U.S. dollar basis. The local currency based return was lower at under one half of one percent. Growth stocks outperformed value in both indices. Healthcare had the top return in both indices followed by the communications sector. Energy was the laggard in the EAFE index while materials had the lowest return in the EM index. On a geographical basis, among developed international markets, most country indices posted a positive return with Israel and New Zealand posting the top returns. Interestingly, the Stoxx Europe 600 index closed the month with a new record high on a local currency basis as the report of sharply lower inflation supported optimism for a rate cut by the European Central bank in September. In emerging markets, returns were mixed. Countries including Philippines, Indonesia, and Thailand had strong positive returns while others including Turkey, Mexico, and South Korea had negative returns. China had a modest positive return even though economic data continues to show that economy continues to weaken. For example, both the manufacturing and services purchasing managers’ indices declined from the prior month.

U.S. bond market sector returns were positive for August. Yields moved down not only in the U.S. but in most other major economies as well as central banks cut interest rates or pointed to cuts coming in the near future. In the U.S., the government bond yield curve inversion (shorter-term bond yields at a higher level than longer-term bond yields) that has been in place since 2022 has been normalizing. The difference between the 2-year Treasury bond yield and the 10-year Treasury bond yield declined with the 2-year yield at 3.93% and the 10-year yield at 3.92% at the end of August. That compares to yields of 4.7% and 4.4% respectively at the end of June. Yields for Treasury bills with less than a year to maturity are still higher than intermediate and long-term maturity bonds. The flight to quality during the equity market sell-off helped corporate, mortgage-backed, and municipal bonds post positive returns for the month. The average 30-year mortgage rate fell to 6.4% and sparked a surge in refinance applications since the average rate was 7.2% a year ago.

The Bloomberg Commodity index eked out only a small positive return for the month since the performance of the various sub-indices was mixed. The industrial and the precious metals sub-indices were the top performers with positive returns. The precious metals index return was boosted by the advance of the price of gold. Gold set a new all-time high as the value of the dollar declined as bond yields dropped in reaction to the Federal Reserve’s comments pointing to a rate cut coming soon. The energy sub-index had a sizeable negative return due to the decline in the price of crude oil due to worries about weakening demand especially from China as that economy continues to slow and expectations for an increase in supply from OPEC+. The price of West Texas Intermediate crude oil dropped about 5% during the month.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Even though the sell-off in equity markets in August reversed quickly, more volatility is likely as the focus of central banks, including the Federal Reserve, shifts from bringing inflation down to supporting labor markets amid some signs of slowing economic growth. Asset valuations are not particularly cheap so market participants will be looking for solid earnings growth to support those valuations. Currently, analyst forecasts show double-digit growth for the S&P 500 into next year. Slower growth in the rate of inflation and easing of monetary policy are likely to be beneficial to consumers and to corporate margins. However, uncertainty remains about if the magnitude and timing of interest rate cuts will enable a “soft landing” or will be too slow to avoid choking off consumer and business spending and investment resulting in a recession.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: