October 07, 2024

September began with a replay of the volatile financial markets in August. Weak reports on new jobs added and manufacturing activity again sent stock prices down sharply in the first week of the month. However, just as in August, markets quickly rebounded. Markets went on to set new all-time highs as the month progressed. Markets rose on optimism for a soft landing in the U.S. and as investors increasingly came to expect a half percentage point interest rate cut by the Federal Reserve (Fed) at the September meeting. Reports such as the consumer price index growth rate dipping to 2.5% from a year ago in August, the lowest reading since early 2021, spurred that optimism. Markets around the globe rose after the Fed did in fact announce its first change in interest rate policy since July 2023 which was the first cut in its federal funds  rate since the covid crisis in 2020. The cut was indeed the half percentage point. The Fed’s revised forecast pointed to more cuts in 2024 and 2025. Equity indices including the Dow Jones Industrial Average, the S&P 500, the STOXX Europe 600, and the Sensex in India rose to new record highs. Bond markets also rallied with U.S. government bond yields dropping to lows for the year. The price of gold also hit record highs in reaction to lower interest rates in the U.S.

rate since the covid crisis in 2020. The cut was indeed the half percentage point. The Fed’s revised forecast pointed to more cuts in 2024 and 2025. Equity indices including the Dow Jones Industrial Average, the S&P 500, the STOXX Europe 600, and the Sensex in India rose to new record highs. Bond markets also rallied with U.S. government bond yields dropping to lows for the year. The price of gold also hit record highs in reaction to lower interest rates in the U.S.

The Fed move was not the only important news during the month. Late in the month, China announced a series of aggressive measures aimed at stimulating that economy and preventing deflation. The stimulus measures came after data continued to show how weak the Chinese economy is. For example, the manufacturing purchasing managers index (PMI) dropped more than expected to 49.1 (under 50 indicates contraction) as both new orders and production declined. Exports, retail sales, and hiring were also lower than prior reports. In addition, the value of new home sales fell almost 30% in August from a year ago, which was worse than the 20% drop in July. The Chinese equity market surged to gain almost 25% on the stimulus news. Equities in other countries, such as European luxury goods companies that are heavy exporters to China, and many commodity prices also got a boost from the news.

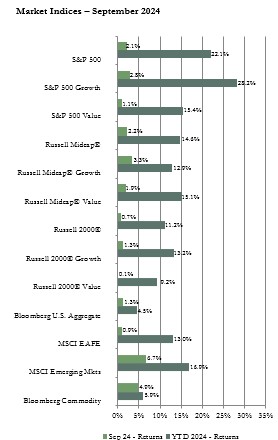

After beginning the month with the largest weekly decline in over a year, the S&P 500 index went on to set five new record closing highs and recorded a 2.1% return for the month. The mid-

capitalization (cap) index had a similar return but the Russell 2000 index of small-cap companies had a weaker performance generating a return of less than 1%. Growth stocks regained momentum and outperformed value stocks in each market cap category. The consumer discretionary, utilities, and communications sectors had the best returns in the large and mid-cap indices while materials and communications were the top performers in the small-cap category. Energy was the poorest performing sector in each market cap category with a negative return reflecting the sharp drop in oil prices during the month.

The MSCI EAFE index of developed international equities posted a small positive return on a U.S. dollar basis and underperformed the U.S. equity market. (The local currency based return was slightly negative.) Even though the European Central Bank and others, such as in Switzerland and Sweden, lowered interest rates again in September, equity returns were weak since economic data reports continued to point to slowing growth. The top performing developed international countries were those that are seen as benefiting from potential improvement in the Chinese economy after the new stimulus measures. The Hong Kong index gained 17% and the commodity heavy economy of Australia gained over 5%. Value outperformed growth in the EAFE even though materials was the top performing sector and healthcare had the worst sector return.

The MSCI Emerging Markets index (EM) outperformed both the S&P 500 and EAFE indices because of the surge in the Chinese equity market late in the month. The dollar based return for the EM was higher than the local currency based return since the dollar depreciated in reaction to the Fed rate cut. China posted a return of almost 25% for the month on the stimulus news. Thailand also had a double-digit gain for the month. Latin America and Emerging Europe were the weakest performing regions. Growth outperformed value in the EM index. Consumer discretionary and communications had the top sector returns with double-digit gains. Energy, with a negative return, had the lowest return among the sectors in the EM index.

All U.S. bond market sector returns were positive for September. Yields moved down not only in the U.S. but in most other major economies as well as central banks cut interest rates or pointed to cuts coming in the near future. In a noteworthy change, the U.S. government bond yield curve uninverted. This means that shorter-term bond yields declined to be lower than intermediate and long-term returns. Short-term yields had been higher than intermediate and long-term yields (inverted) since 2022. Yields for bills with one-year or less to maturity, which are closely tied to the fed funds rate target, are still higher than longer-term bond yields. The benchmark 10-year Treasury bond yield briefly declined to the lowest point of the year at 3.6% but ended the month at 3.8% which is down from 3.9% at the end of August and down significantly from 4.4% at the end of the second quarter. The average 30-year mortgage rate fell to a two-year low of 6.1% and sparked a surge in refinance applications.

The Bloomberg Commodity index gained almost 5% for the month since most sub-indices had gains for the period. Petroleum was the only sub-index we track that had a negative return. That index declined, reflecting the sharp drop in the price of oil during the month. The price of West Texas Intermediate (WTI) crude oil dropped to as low as $66.73 per barrel, the lowest in over a year, and ended the month down 8% from the end of August. Weak demand particularly from China hurt oil prices. However, comments from OPEC+ indicating plans to increase production and from Saudi Arabia saying it will cut its price to gain market share also pressured the oil market. The industrial and precious metals sub-indices were the top performers with solid positive returns. Industrials metals prices rose on hopes of higher demand from China as stimulus measures work through that economy. The precious metals index return was boosted by the advance of the price of gold. Gold set multiple new highs during the month as the value of the dollar declined as bond yields dropped in reaction to the Fed’s rate cut.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Asset valuations are not particularly cheap with indices hitting new record highs during the month. Therefore, market participants will be looking for solid earnings growth to support those valuations when the corporate earnings season begins in mid-October. Currently, analyst forecasts show double-digit growth for the S&P 500 into next year. Slower growth in the rate of inflation and easing of monetary policy are likely to be beneficial to consumers and to corporate margins. However, a risk remains that the lagged impact of the Fed’s higher for longer interest rate policy is still filtering through the economy and may still slow the labor markets and spending. If China’s stimulus measures are effective, the headwind to various sectors over the past two years could ease, but most of the measures have been to enhance liquidity rather than spur consumer demand.

Therefore, our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: