November 05, 2024

Uncertainty about the rate of inflation and therefore the path of interest rate policy moves by the Federal Reserve (Fed) spurred volatilty in financial markets again in October. Investors were optimistic when the latest Fed meeting minutes showed that the majority of members favor additional interest rate cuts. However, expectations quickly shifted. The consensus expectation shifted away from another half percentage point rate cut in November to expecting a quarter point cut after a strong employment report and a bump up in inflation. The employment report showed the number of new jobs added coming in significantly above expectations and wage growth up 4% year-over-year. The consumer price index (CPI) report showed inflation is sticky since the core CPI rose to 3.3% from the prior year. The expectations for a less aggressive Fed move sent bond yields higher (and prices lower) with the 10-year Treasury bond yield again above 4%. The slower rate cut expectations also pressured interest sensitive stocks such as REITs but sent the price of gold to record highs.

Mixed messages from corporate earnings reports further fueled that volatility. The earnings season started with stronger than expected earnings reports from big banks that sent equity indices to record highs. Later, disappointing reports from stocks such as UnitedHealth and ASML sent markets lower but markets rose in reaction to a strong report from Tesla. It is noteworthy that the majority of companies reporting earnings during the month beat analysts’ forecasts. However, many stocks experienced steep price drops because the forward looking comments by management worried investors. The biggest reactions came after technology companies disclosed the high level of spending necessary to build artificial intelligence (AI) products and services. Other companies described how shifting consumer preferences and slowing demand are limiting pricing power and pressuring margins.

Mixed messages from corporate earnings reports further fueled that volatility. The earnings season started with stronger than expected earnings reports from big banks that sent equity indices to record highs. Later, disappointing reports from stocks such as UnitedHealth and ASML sent markets lower but markets rose in reaction to a strong report from Tesla. It is noteworthy that the majority of companies reporting earnings during the month beat analysts’ forecasts. However, many stocks experienced steep price drops because the forward looking comments by management worried investors. The biggest reactions came after technology companies disclosed the high level of spending necessary to build artificial intelligence (AI) products and services. Other companies described how shifting consumer preferences and slowing demand are limiting pricing power and pressuring margins.

Other important news during the month included news that the rate of inflation is back to below the 2% target level of various central banks. The CPI in Canada fell to 1.6% which enabled the Bank of Canada to make its third cut to its key interest rate this year. In the United Kingdom, CPI dropped to below 2% for the first time in three years. CPI in the eurozone fell to 1.8%. With inflation under target and the employment rate falling for the third consecutive month, the European Central Bank cut its interest rate for the third time this year.

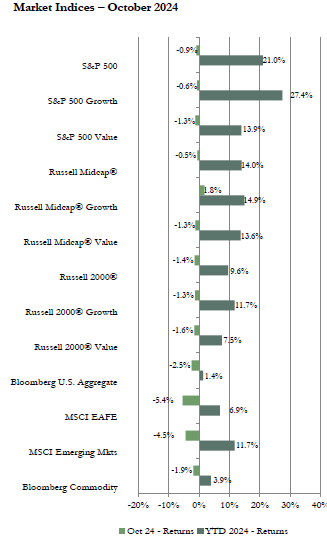

Despite the Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq Composite hitting new record highs during the month, the major U.S. equity market indices finished October with negative returns. Stock prices rose early in the month boosted by Fed meeting minutes that showed most members support more rate cuts and by strong earnings reports particularly by banks. Late in the month better than expected earnings reports from Magnificent 7 stocks Alphabet and Netflix provided another boost. However, U.S. equities had a steep sell-off on the last day of the month spurred by announcements by Microsoft and Meta Platforms about the growing cost of building out AI capabilities that cast doubts on the potential returns for AI related companies. By the end of the month, the Russell mid-capitalization (cap) index declined less than the S&P 500 and both outperformed the Russell 2000 index of small-sized companies. Growth outperformed value in each market cap category. The financials sector had the top performance in the S&P 500. Energy had the best return in the mid-cap index and consumer staples led in the small-cap index. Healthcare was the weakest performing sector in the S&P 500 and the mid-cap index while consumer discretionary lagged in the small-cap index.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index each had a negative return for the month. Both underperformed the U.S. equity indices by a modest amount on a local currency basis. However, both lagged the U.S. indices by a wide margin on a U.S. dollar basis since the dollar strengthened due to resilient economic data. Each of the 11 industry sectors in the EAFE index and 10 of the 11 sectors in the EM index posted a negative return for the month. Financials had the best sector return in the EAFE index due to strong earnings reports while materials was the laggard due to demand concerns since the industrial side of the economy is struggling. Information technology, with a positive return, had the best sector return in the EM index boosted by positive news in the semi-conductor sector while energy had the lowest return. On a geographical basis, among developed international markets, Israel was the lone country with a positive return. The Far East outperformed Europe. European equity markets were hurt by the continued weakness in the industrial sector. In emerging markets, Taiwan was the top performing country with a positive return boosted by technology stocks while most other countries posted a negative return. Emerging Europe was the worst performing region, hurt by higher than expected inflation reports. The India index was one of the weakest performers among EM markets since share prices there were pressured by weak earnings reports. Chinese stocks were lower as stimulus optimism faded hurt by data such as the manufacturing and services PMI reports moving lower.

U.S. bond market sector returns were negative for October. Yields moved up (and bond prices moved down) across the yield curve due to strong economic data reports dampening hopes for another half percentage point interest rate cut by the Fed in November. The 10-year Treasury bond yield increased to 4.3% at the end of October from 3.8% at the end of September. As yields rose, mortgage rates rebounded to the levels seen in August.

The Bloomberg Commodity index had a negative return for October. The livestock, petroleum, and precious metals sub-indices each generated a positive return but those gains were offset by negative returns for other agricultural commodities, industrial metals, and the broader energy sector. Crude oil prices rose at the beginning of the month on Middle East war worries and concerns about supply from hurricane disruptions but moved gradually lower as the month wore on. The price of natural gas declined on weakening demand. Gold hit multiple new record highs during the month on strong demand from China and broad safe haven demand because of various geopolitical risks.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Asset valuations are not particularly cheap with indices hitting more new record highs during the month. Stock selection could become increasingly important since earnings will need to grow to support the high valuations. Much of the U.S. economy has remained resilient despite the higher interest rates from the Fed’s fight against inflation. The labor market seems to have cooled but unemployment remains low, wages continue to move up, and the number of job openings remains above prepandemic levels. The solid labor market has been supporting the all important consumer spending side of the economy. However, there is still the risk that the lagged effect of high interest rates could begin to spread beyond the housing, auto, and manufacturing sectors. Elevated input costs and weakening demand along with reduced pricing power are risks to earnings growth particularly for consumer oriented companies. Outside the U.S., inflation appears to be tamed and is near or below central bank targets. Now the focus is on growth and the picture is mixed with services outpacing manufacturing.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: