December 05, 2024

At the start of November the S&P 500 index set new record highs and crossed the 6,000 mark as market participants cheered results of elections and the interest rate cut by the Federal Reserve (Fed) at its latest meeting. The S&P 500 gained almost 5% for the first week of the month. Small-capitalization (cap) stocks rallied more with the Russell 2000 index gaining over 8%. The next week, the equity market gave back much of the post-election/Fed action gains. Higher than expected inflation, services activity, and retail sales reports dampened the prior optimistic momentum as worries set in that the economy is too strong to warrant additional Fed interest rate cuts. Fuel was added to the sell-off when Fed Chair Powell talked about the possibility that the resilient economy and the stall in the downtrend in inflation could slow the pace of interest rate cuts. Those same data and comments drove bond yields sharply higher with  the 10-year Treasury bond yield going up to 4.5%, near the high for the year. Higher interest rates pushed the price of the dollar up to a multi-year high which drove the prie of commodities like gold, copper, and oil lower. However, markets shifted again as investors reacted to robust technology stock earnings reports, solid economic data, and the nomination of Scott Bessent as Treasury Secretary. The S&P 500 climbed and closed the month at another record high while bond yields retreated to below where they began the month.

the 10-year Treasury bond yield going up to 4.5%, near the high for the year. Higher interest rates pushed the price of the dollar up to a multi-year high which drove the prie of commodities like gold, copper, and oil lower. However, markets shifted again as investors reacted to robust technology stock earnings reports, solid economic data, and the nomination of Scott Bessent as Treasury Secretary. The S&P 500 climbed and closed the month at another record high while bond yields retreated to below where they began the month.

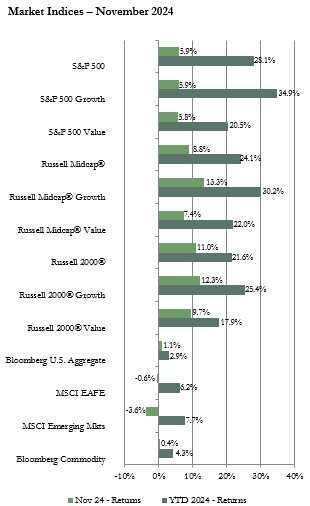

U.S. equity market indices posted sizable positive returns for November. The S&P 500 index had its largest monthly gain of the year at 6%. However, small and mid-cap stock indices rose more. The Russell 2000 index of small-cap stocks was the performance leader with a gain of 11%. Small sized companies are seen as the main beneficiaries of the “America First” trade policy expected from the new Trump administration. Growth outperformed value in each market cap category but the performance gap was wider in the small and mid-cap categories than in the large-cap category. From a sector perspective, financial and energy sector stocks benefited from the hope for less regulation and easier merger approvals in the Trump era and were among the top performing sectors in the major indices. Consumer discretionary stocks also posted top gains on optimism for an accelerating economy boosted by the rise in consumer confidence after the elections.

In international market news, the Bank of England and the Riksbank of Sweden cut interest rates by a quarter of a percentage point and a half point, respectively. However, Brazil raised its key rate by a half percentage point due to a pick-up in inflation. China reported that exports rose more than expected with a 13% gain. The Chinese government announced additional stimulus measures but the consensus continues to view the stimulus measures as insufficient to resolve the real estate and consumer confidence problems in that country.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index each had a negative return for the month. Equity prices in Europe, Asia, and Latin America were pressured by concerns about the impact of Trump trade policy and tariff actions. International stocks were also hurt by data showing consumer spending weakness in Europe and China. U.S. dollar based returns for the EAFE and EM indices were lower than local currency returns since the dollar was up sharply on expectations that Trump’s policies could be inflationary which would limit further Fed interest rate cuts. Worries about a stronger dollar were especially negative for EM stock prices.

All sectors of the U.S. bond market posted positive returns for November. Despite the quarter percentage point cut in the fed funds rate at the start of the month, yields moved up (and bond prices moved down) across the yield curve after strong economic data reports and Fed member comments suggesting there is no need to rush into further interest rate cuts created worries that interest rates may stay higher for longer than anticipated just weeks ago. However, yields gradually declined in the second half of the month. For example, the 10-year Treasury bond yield ended the month at 4.2% down from 4.3% at the end of October.

The Bloomberg Commodity index had a small positive return for November. The energy and agriculture sub-indices were the performance leaders with positive returns. The energy sub-index gained since supply concerns drove the price of natural gas up over 20%. The agriculture sub-index was driven higher by the spike in coffee prices which offset lower grain and livestock prices. The industrial metals, petroleum, and precious metals sub-indices each had a negative return. The precious metals index was down the most, dragged down by profit taking amid reduced demand for safe haven assets.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Much of the U.S. economic data continues to show resilience despite the higher interest rates from the Fed’s fight against inflation. The labor market has cooled but unemployment remains low, wages continue to move up, and the number of job openings remains above prepandemic levels. The solid labor market has been supporting the all- important consumer spending side of the economy. However, there is still the risk that the lagged effect of high interest rates could begin to spread beyond the housing, auto, and manufacturing sectors. Outside the U.S., inflation is near central bank targets. Now the focus is on growth and the picture is mixed with services outpacing manufacturing. However, indications are that central banks will make additional interest rate cuts next year to support economic activity. Given the stronger growth data in the U.S. compared to various developed and emerging markets, the uncertain impact of Trump administration tariffs and trade policy on foreign economies, and the likelihood that the U.S. dollar will continue to be strong, our recommendation to be underweight non-U.S. stocks remains in place. The high valuation levels particularly in U.S. large-cap stocks, increases the risk of heightened volatility due to unexpected earnings, economic, or geopolitical news. Therefore, we retain the recommendation for an equal weight to U.S. stocks and an overweight to cash reserves.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We recommend a neutral weight position in U.S. equities and an underweight in international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: