March 05, 2025

Trade war developments were the dominate factor impacting financial markets during February. The frequently changing narrative fueled a high level of uncertainty which weighed on business and consumer sentiment particularly in the U.S. Early in the month some solid earnings reports and Trump’s decision to delay new tariffs on Canadian, Mexican, and Chinese imports for 30 days boosted equity markets with the S&P 500 and Nasdaq stock indices hitting new record highs on February 19. However, economic growth concerns were bubbling up due to tariff uncertainty, sticky inflation data, the largest drop in retail sales in two  years, and housing starts down almost 10% from the prior month. Then surprisingly weak forward earnings guidance from Walmart spooked investors and set off a sharp sell-off in U.S. equities. The sell-off gained momemtum into the end of the month as recession worries intensified as more weak economic data came out, such as the consumer confidence index posting the largest monthly drop since August 2021, and President Trump confirmed that the new tariffs would be implemented March 4. U.S. equity markets finished the month with negative returns. However, the economic growth concerns drove up demand for the safety of Treasury bonds with prices rising and yields falling. The growth concerns also increased expectations that the Federal Reserve will cut interest rates three times this year which helped drive yields lower. While equity markets were weak in the U.S., other markets had hefty gains. The Stoxx Europe 600 index rose to new record highs during the month boosted by hopes for an end to the war in Ukraine as well as by expectations for economic stimulus from increased defense spending and additional interest rate cuts. Stocks in China rallied led by strong earnings for technology stocks and on hopes that U.S. tariffs will be less than originally expected. Gold hit a new all time high during the month on safe haven demand.

years, and housing starts down almost 10% from the prior month. Then surprisingly weak forward earnings guidance from Walmart spooked investors and set off a sharp sell-off in U.S. equities. The sell-off gained momemtum into the end of the month as recession worries intensified as more weak economic data came out, such as the consumer confidence index posting the largest monthly drop since August 2021, and President Trump confirmed that the new tariffs would be implemented March 4. U.S. equity markets finished the month with negative returns. However, the economic growth concerns drove up demand for the safety of Treasury bonds with prices rising and yields falling. The growth concerns also increased expectations that the Federal Reserve will cut interest rates three times this year which helped drive yields lower. While equity markets were weak in the U.S., other markets had hefty gains. The Stoxx Europe 600 index rose to new record highs during the month boosted by hopes for an end to the war in Ukraine as well as by expectations for economic stimulus from increased defense spending and additional interest rate cuts. Stocks in China rallied led by strong earnings for technology stocks and on hopes that U.S. tariffs will be less than originally expected. Gold hit a new all time high during the month on safe haven demand.

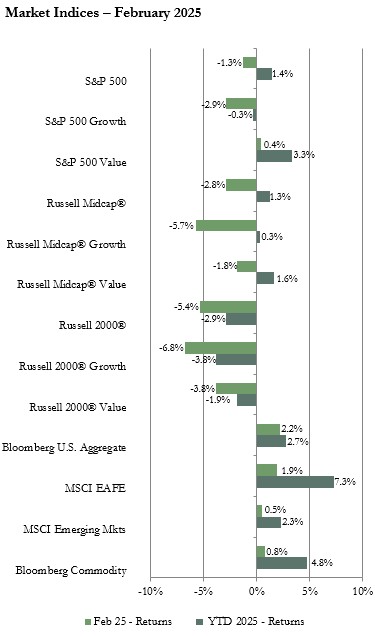

Major U.S. equity market indices posted negative returns for February. The broad index of larger capitalization (cap) stocks, the S&P 500, ended with a modest negative return after setting a new record high in mid-month. Small and mid-cap stock indices declined more. Value outperformed growth in each market cap category by a sizeable margin. In the risk-off climate, defensive sectors such as consumer staples and utilities had the best returns. The real estate sector was another top performing sector boosted by falling bond yields. Consumer discretionary, technology, communications, and industrials had some of the weakest returns hurt by concerns about the earnings growth potential from artificial intelligence projects as well as worries about recession or stagflation.

The MSCI EAFE index of developed international equities outperformed both the U.S. indices and the MSCI Emerging Markets (EM) index. Both the EAFE and EM had a positive return for February. Currency movements had a positive impact on the return for international investments for U.S. investors since the U.S. dollar declined modestly. Just as in the U.S., value outperformed growth in the EAFE and EM. Each of the industry sectors in the EAFE index, with the exception of technology, earned a positive return for the period. Financials had the best sector return boosted by strong profitability for European banks. Consumer discretionary had the best sector return in the EM index while the energy sector had the lowest return. On a geographical basis, among developed international markets, Europe outperformed the Far East and Pacific regions by a wide margin. Better than expected economic growth data, strong earnings reports, and a rally in defense stocks on signs that Europe may lift limits on military spending drove European equity markets higher. The Japanese equity index had a negative return for the month hurt by U.S. tariff impact concerns and monetary tightening by the central bank. In emerging markets, China’s equity market rallied and posted a double-digit gain for the period on better than expected earnings from leading technology companies and hopes the U.S. tariffs will be weaker than originally announced. Poland continued its 2025 rally with an 8% gain. India continued its sell-off with another negative return. Concerns about weakness in bank earnings and the impact of potential U.S. tariffs caused investors to shift capital out of India after prior strong performance drove valuations to high levels.

All sectors of the U.S. bond market posted positive returns for the month. Early in the month bond yields moved higher as sticky inflation data led Federal Reserve members to comment that there is no need to be in a hurry to cut rates. The 10-year Treasury bond yield rose to as high as 4.6%. However, yields dropped sharply as the month went on as mixed economic data and tariff talk fueled economic growth concerns which raised expectations for rate cuts later in the year. The 10-year Treasury yield was 4.2% at the end of the month.

The Bloomberg Commodity index had a small positive return for February. The energy sub-index had the highest return for the period boosted by a spike in natural gas prices due to cold weather and tight supply. Petroleum prices moved lower during much of the period. The industrial metals sub-index had the second best return of the sub-indices we track boosted by a surge in the price of copper related to supply disruptions. The precious metals index also had a positive return reflecting the increase in the demand for gold on safe haven trading.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

We made a change to our tactical asset allocation recommendations. The recommendation for developed international market equities was raised to equal weight from underweight due to shifts in macroeconomic and geopolitical conditions that could be positive catalysts, particularly in Europe. A main catalyst is that economic growth data has recently been coming in better than expected in Europe and the UK. This may continue if energy costs in Europe come down helped by more imports of natural gas from the U.S. Also, there are indications that European leaders are willing to ease debt and military spending limitations, which could stimulate economic activity. Additional stimulus is expected from further central bank interest rate cuts. The impact of tariffs is a risk. However, the extent and timing of tariffs and any retaliatory actions as well as the inflation and growth implications of those actions are uncertain due to the fluid nature of the actions and negotiations. Therefore, diversification across regions and asset classes is likely to be beneficial.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: