April 02, 2025

Tariffs, inflation, recession, retailiation, and uncertainty. These words were repeated over and over in story after story and dominated the news and commentary during March. Consumers, businesses, and market participants could not escape the speculation about what may be coming from the U.S. and other countries on the tariff front and what the impacts will be. The constant barrage of tariff talk and the uncertainty it created dampened consumer confidence, paralyzed business decision making, and weighed on equity markets. For example, according to the Conference Board’s index, consumer confidence fell to the lowest reading since 2021. The NFIB Small Business Uncertainty index rose to 104, the second highest level in the history of the index. The AAII individual investors survey showed bearish sentiment was above 60% for only the sixth time since 1987 which helps explain the equity market decline that has now wiped out all the  U.S. equity market gains after the November election. Safe haven assets benefited however, with gold hitting several new all time highs during the month.

U.S. equity market gains after the November election. Safe haven assets benefited however, with gold hitting several new all time highs during the month.

Despite the angst related to the tariff talk and worries about inflationary and economic impacts, there was some better than expected macroeconomic news reported in the U.S. and various other regions. For example, in the U.S. existing homes sales rose 4.2% and housing starts were up 11.2%. Durable goods orders were up 0.9% and core retail sales rose 1%. The consumer price index rose only 0.2% from the prior month and 7.74 job openings were reported with 151,000 new jobs created. Each of these data points was better than consensus expectations. Elsewhere, manufacturing production in the eurozone increased for the first time in two years and the purchasing managers index (PMI) manufacturing index hit a two-year high. Retail sales in China jumped 4% from a year ago with fixed asset investment also increasing 4%. The China manufacturing PMI ticked up back into expansion territory. Also, importantly, new leadership in Germany proposed a fiscal spending package that includes over €1 trillion in new defense and infrastructure spending. If approved this stimulus is likely to not only boost economic activity in Germany but across the European Union. China also signaled more stimulus to come and loosened the fiscal deficit goal to the highest since 1994 in an effort to boost consumption.

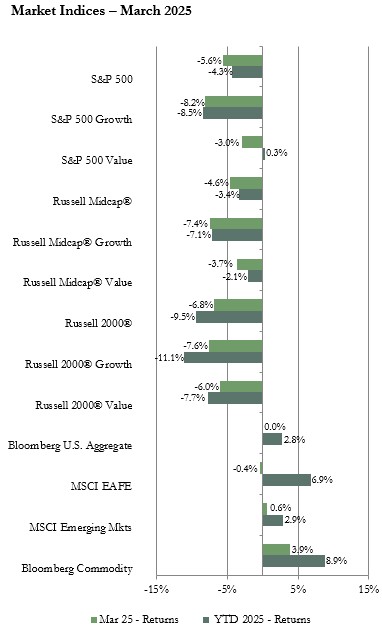

For the second consecutive month, major U.S. equity market indices posted negative returns. The S&P 500 index briefly dipped into correction territory (down 10% from the prior peak on February 19) for the first time since October 2023. However, equities rallied after the Federal Reserve Open Market Committee meeting where the committee retained its forecast for two rate cuts in 2025 and after solid macroeconomic data reports at least temporarily eased recession worries. The Russell Midcap index declined less than the S&P 500 index in March, and the S&P 500 declined less than the Russell 2000 index of small capitalization (cap) stocks. In an interesting turn of events, the prior market leading Magnificent seven stocks underperformed the broader market. The Roundhill Magnificent Seven exchange traded fund that tracks the performance of the Magnificent seven stocks was down over 10% for the month, about double the decline for the S&P 500 index. Value outperformed growth in each market cap category by a sizeable margin since the technology, consumer discretionary, and communications sectors had the largest declines. These sectors were hurt by growing concerns about what the payback will be from the huge about of spending on artificial intelligence projects in addition to concerns that coming tariffs will hurt corporate earnings by boosting inflation and slowing economic activity. In the risk-off climate that dominated during the month, defensive sectors such as consumer staples and utilities, as well as the energy sector, had the best returns as risk averse investors rotated into high dividend paying stocks.

Both the MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index outperformed the U.S. equity indices again in March. In fact, this was the fourth consecutive month that the EAFE index outperformed the S&P 500. In March, the EM index was the performance leader with a small positive return compared to negative returns for the EAFE and S&P 500. Currency movements had a positive impact on the return for international investments for U.S. investors since the U.S. dollar declined significantly. Just as in the U.S., value outperformed growth in the EAFE and EM. Sector performance in the EAFE was similar to the S&P 500 with energy and utilities posting the highest returns among the 11 sectors with technology and consumer discretionary at the bottom of the performance ranking with negative returns hurt by tariff impact worries. Sector returns in the EM index were mostly similar to the EM and S&P with utilities as one of the performance leaders and technology posting the worst sector result. (Technology was the only sector in the EM to have a negative return.) However, in the EM, the materials sector had the top return. On a geographical basis, among developed international markets, the Euro and Far East indices outperformed the Pacific ex Japan region. Solid gains for the Spain, Italy, and Portugal indices boosted the Euro index return. Those three countries had the highest growth rates in Europe helped by tourism and a strong service economy. In emerging markets, equities rallied in Greece and India with both country indices posting about a 10% gain. At the other end of the performance spectrum, the Taiwan equity market declined almost 12% in March hurt by U.S. plans to boost tariffs on autos, auto parts, and semiconductors.

Many sectors of the U.S. bond market posted positive returns for the month. Treasury bond yields moved in a relatively tight range during the month increasing at times reacting to uncertainty around the potential inflationary impact of Trump administration tariff policies and declining at times when investors worried about economic growth slowing. After the ups and downs, Treasury bond yields ended March at about the same levels as at the start of the month. The benchmark 10-year Treasury bond yield was 4.2% at the end of March compared to yields of 3.9% and 4.6% for the 2-year and 30-year Treasuries, respectively. Corporate high yield and municipal bonds were two sectors that recorded negative returns for the month. Worries about tariff impacts on corporate earnings weighed on the high yield sector while seasonal weakness dampened the municipal market.

The Bloomberg Commodity index had a positive return for March. The precious metals sub-index had the highest return for the period with a double-digit gain boosted by rising gold and silver prices as investors rotated away from risky equity markets to safe haven assets. Gold surpassed the $3,000 per ounce level and set several record highs during the month. The livestock, industrial metals, and energy sub-indices also each posted a solid gain for the period. Petroleum prices fell early in the month to a three-year low on recession worries, but moved higher during much of the month as escalating Middle East tensions increased supply concerns.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

The impact of tariffs is a continuing risk to corporate earnings and financial market performance. However, the extent and timing of tariffs and any retaliatory actions as well as the inflation and growth implications of those actions are uncertain due to the fluid nature of the actions and negotiations. For now, the U.S. economy appears solid enough to withstand the current uncertainty. The labor market is resilient creating above 100,000 new jobs per month with the number of new unemployment claims staying steady at a low level and wage growth slowing but still above the inflation rate. Corporate earnings are likely to slow and analysts have lowered their estimates. However, analysts are still expecting positive earnings growth. International markets have outperformed the U.S. so far this year and while tariff policies will impact those regions also, stimulus measures and potentially more interest rate cuts may boost economic activity, earnings, and financial markets further in those regions. Therefore, diversification across regions and asset classes is likely to be beneficial as global economies and markets navigate and adjust to potentially significant changes to policies and the business and consumer reactions to those policies.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: