May 09, 2023

Market participants continued to focus throughout April on the questions of whether the Federal Reserve Open Market Committee (FOMC) will raise its fed funds rate again and will the impact of that tighter monetary policy tip the economy into recession. FOMC member comments during the month were mostly hawkish pointing to another quarter of a percentage point rate hike. The recession question was a bit murky since economic data releases and corporate earnings reports were mixed. Investors mulled similar questions for Europe and other regions. In the end, U.S. large-capitalization (cap) and international developed stock indices posted modest gains while U.S. small-cap, U.S. mid-cap, and the emerging markets equity indices were down for the month. Most bond market indices had gains in April. While gold rallied to the highest level since August 2020, prices for most commodities were down.

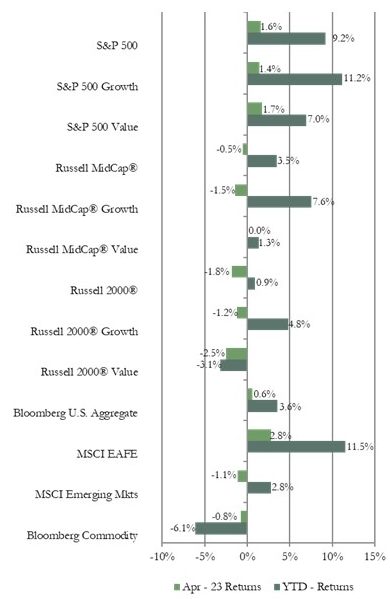

Market Indices – April 2023

In economic news, on the positive side, inflation rates moved lower again with the U.S. consumer price index (CPI) dropping to 5.0% year-over-year from 6.0% in the prior month due to lower rent rates. The producer price index (PPI) came in lower than expected at -0.5%. First quarter gross domestic product (GDP) growth of 1.1% was above forecasts even though it was lower than the fourth quarter growth of 2.6%. In the labor market, the unemployment rate unexpectedly dropped to 3.5%. Even though, the number of job openings declined 6%, there are still almost 10 million jobs open. On the not so bright side, the U.S. ISM purchasing managers’ index (PMI) of manufacturing activity moved down to 46.3, which is the lowest level since May 2020 in the height of the Covid shutdowns. Importantly, new orders were also down. The PMI for services activity turned lowered and dropped to 51.2 from 55.1 in the prior month. New service orders were also lower. Outside the U.S., Germany reported an increase in industrial production and new orders, but manufacturing activity indices were lower in Europe, Japan, South Korea, and China. India is the bright spot with manufacturing activity in expansion. Service sector activity was up in China continuing the rebound from the Covid lockdown era. Retail sales were down in Europe but up sharply in China.

In economic news, on the positive side, inflation rates moved lower again with the U.S. consumer price index (CPI) dropping to 5.0% year-over-year from 6.0% in the prior month due to lower rent rates. The producer price index (PPI) came in lower than expected at -0.5%. First quarter gross domestic product (GDP) growth of 1.1% was above forecasts even though it was lower than the fourth quarter growth of 2.6%. In the labor market, the unemployment rate unexpectedly dropped to 3.5%. Even though, the number of job openings declined 6%, there are still almost 10 million jobs open. On the not so bright side, the U.S. ISM purchasing managers’ index (PMI) of manufacturing activity moved down to 46.3, which is the lowest level since May 2020 in the height of the Covid shutdowns. Importantly, new orders were also down. The PMI for services activity turned lowered and dropped to 51.2 from 55.1 in the prior month. New service orders were also lower. Outside the U.S., Germany reported an increase in industrial production and new orders, but manufacturing activity indices were lower in Europe, Japan, South Korea, and China. India is the bright spot with manufacturing activity in expansion. Service sector activity was up in China continuing the rebound from the Covid lockdown era. Retail sales were down in Europe but up sharply in China.

In corporate earnings news, about three-quarters of the S&P 500 companies that have reported

earnings beat analysts’ estimates. Many money center banks, technology and communications companies such as Microsoft, Alphabet, and Meta Platforms, and consumer and healthcare companies such as Procter & Gamble and HCA Healthcare reported solid earnings and positive outlooks which drove their stock prices higher. In contrast, regional banks, and companies across a variety of industries such as Tesla, AT&T, and United Parcel Service reported disappointing results and weaker outlooks due to economic headwinds.

Major U.S. equity market index returns were mixed for April. The S&P 500 index of larger-cap stocks posted a positive return while the Russell Midcap and the Russell 2000 index (small-cap) each had a negative return. The value index outperformed the growth index in both the S&P 500 and the Russell Midcap but growth outperformed value in the Russell 2000 index. There were no clear sector performance trends. For example, the communications sector was the top performing among the 11 sectors in the S&P 500 while that sector was the worst performing sector in the Russell 2000 index with a double-digit negative return. Consumer staples was the top performing sector in the Russell Midcap index and healthcare topped the performance chart in the Russell 2000.

The MSCI EAFE index of developed international equities outperformed the major U.S. equity market indices as well as the MSCI Emerging Markets (EM). The dollar based return was higher than the local currency return for the EAFE index. However, the dollar based return for the EM index was lower than the local currency return. Value stocks outperformed growth stocks in both the EAFE and EM indices. Energy and the defensive sectors of utilities, consumer staples, and healthcare, were the top performers in the EAFE index while information technology and materials were the poorest performing sectors each posting a negative return. Energy and financials topped the sector performance rankings in the EM index while consumer discretionary and communications had the lowest returns. On a geographic basis, Europe outperformed other regions on optimism surrounding some better than expected economic data and corporate earnings. The Pacific region had the weakest return but posted a small positive return. The EM index return was dragged down by negative returns for China, Korea, and Taiwan. China had the weakest return due to ongoing tensions with the U.S. and other Western countries. Taiwan was pressured by weakening demand for one of its main exports, semiconductors. Eastern Europe was the strongest performing EM region with Poland the top performing country in the EM index boosted by the improving energy supply/cost situation.

All sectors of the U.S. bond market posted a positive return for April except municipal bonds. Yields moved up and down in reaction to economic news and FOMC member comments but ended little changed from the prior month-end. For example, the 10-year Treasury bond yield dropped to 3.4% at the end of April compared to 3.5% at the end of March. Bonds with longer time to maturity outperformed shorter maturity bonds. The corporate high yield bond sector had the best return as prices rebounded from the indiscriminate sell-off following the bank crisis in March. A large amount of new issuance pressured the municipal bond segment.

The Bloomberg Commodity index had a negative return for the month due primarily to the drag from the grains, industrial metals, and energy sectors. Wheat and corn prices declined as markets continue to normalize after the Ukraine war supply shock. The price of copper, zinc, and aluminum declined on weaker than expected demand primarily from China. The livestock sub-index was the performance leader followed by precious metals, particularly silver.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Even though inflation rates may have peaked, inflationary pressures continue to persist and the Fed and other central banks seem intent on continuing their hawkish positioning. Bank lending standards have been tightening for a few months and the recent banking crisis may result in even tighter access to credit for consumers and business, particularly small businesses that depend on regional and community banks, as banks seek to retain liquidity and reduce risk. This could be a drag on economic growth in an environment of already mixed economic conditions. Therefore, it is likely financial markets will continue to be volatile while there is heightened uncertainty about the impact of tighter monetary conditions on corporate profits. We continue to recommend an overweight to cash reserves. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality.

We retain our neutral weight position recommendation for developed market and emerging market equities. Since bond yields are more attractive than they have been in many years, we encourage investors to revisit fixed income allocations. Our fixed income recommendation is for an equal weight position relative to long-term targets. We favor shorter maturity bonds due to the steeply inverted yield curve. We recommend an underweight allocation to hedge funds. Within the hedge fund sector our view is that the opportunity set for distressed investing strategies may be improving as interest rates are at multi-year highs and credit conditions are tightening.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: