May 06, 2024

After five months of positive returns, U.S. equity markets turned down in April. The bond market was also down as investors recalibrated expectations for rate cuts by the Federal Reserve (Fed). The consensus moved from expecting a cut in May or June to not seeing a cut until September or even later. The change in expectations is because progress on bringing inflation down has stalled with inflation measures such as the consumer price index (CPI) up for three months in a row and core services prices moving higher. The CPI index released in April was up 3.5% on a year-over-year basis, which was the highest in 12 months and above analysts’ forecasts. Worries about inflation were further fueled by reports that show the labor market continues to be tight with nonfarm payrolls again beating expectations by a wide margin, weekly initial unemployment claims remaining at historically low levels, and employment costs moving higher. Wages grew 4.1% year-over-year in part because the unemployment rate declined to 3.8% and has been under 4.0% for 26 consecutive months and the number of job openings was at a still high 8.8 million even though it ticked down slightly from the prior month. A better than expected manufacturing report and a strong retail sales report pointed to a resilient economy that had certain Fed members saying they were in no hurry to cut rates. Corporate earnings season added to the volatility in the equity market. Earnings reports have been mixed. Various companies have reported better than expected first quarter earnings, but many have cautioned that growth will likely slow in the second half of the year due to increasing costs, slowing sales, or increasing investment spending. Certain consumer companies reported lower sales citing customers balking at high prices and reduced sales in China and the Middle East. Non-U.S. equity markets fared better than U.S. markets as some economic improvement was reported in Europe and China. The commodity index outperformed stocks and bonds due to higher industrial and precious metals prices.

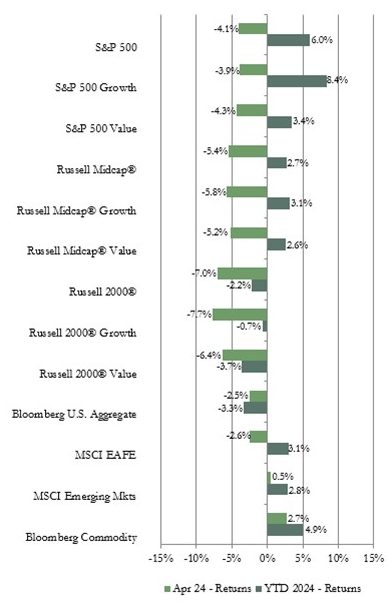

Market Indices – April 2024

Returns were negative across the board in the U.S. equity market. However, the larger capitalization (cap) S&P 500 index declined less than the Russell mid and small-cap indices. Rising interest rates tend to pressure small-cap stocks more than large-cap stocks since smaller companies tend to be more dependent on borrowing. Growth outperformed value in the

Returns were negative across the board in the U.S. equity market. However, the larger capitalization (cap) S&P 500 index declined less than the Russell mid and small-cap indices. Rising interest rates tend to pressure small-cap stocks more than large-cap stocks since smaller companies tend to be more dependent on borrowing. Growth outperformed value in the

S&P 500 but value outperformed growth in the mid and small-cap indices. The defensive utilities sector was the top performing sector in each market cap category. In fact, utilities was the only sector to post a positive return in the S&P 500 and Russell Midcap index. No sectors in the Russell 2000 had a positive return. Energy was another top performing sector in the large and mid-cap indices while materials had the second best return in the small-cap index. The lagging sectors varied by market cap and included real estate, materials, and healthcare in the large-cap, mid-cap, and small-cap indices respectively.

The MSCI EAFE index of developed international equities posted a negative return for April but outperformed the U.S. equity market. The MSCI Emerging Markets index (EM) posted a small positive return, due in large part to a rebound in Chinese equities, and outperformed both the U.S. and developed international indices. Local currency returns were higher than dollar based returns for both the EAFE and EM due to the strengthening U.S. dollar on the high for longer interest rate view. Value outperformed growth in both the EAFE and EM. Energy and healthcare had the top sector returns in the EAFE while communications and consumer discretionary led in the EM. Information technology was a laggard in both indices. On a geographical basis, among developed international markets, Hong Kong was a top performing country reflecting robust cash inflows into that market due to compelling valuations and signs of some improvements in the Chinese economy. Stock indices for various European countries benefited from strong tourism, lower inflation reports, and some improvement in industrial production. Among emerging markets, Turkey had the best return with a 14% gain boosted by government efforts to contain inflation. China was another top performing country with a gain of over 6% on signs of some economic improvement such as the manufacturing purchasing managers index rising back into expansionary territory due to an increase in production. India also had a positive return. Indonesia and the Philippines were laggards.

U.S. bond market sector returns were negative for April. Yields moved up in reaction to stronger than expected economic news and inflation measures that ticked up from the prior month. For example, the 2-year Treasury bond yield moved up to 5.0% from 4.6% at the end of March. The 10-year Treasury bond yield rose to 4.7% from 4.2% on March 31. In the rising yield environment, longer time to maturity bonds had the largest negative returns. The average 30-year mortgage rate moved back up to over 7%.

The Bloomberg Commodity index had a positive return for April. Most of the sub-indices we track also recorded a positive return with only the livestock and petroleum sub-indices posting a negative return. The industrial metals sub-index had the top return with a double-digit gain boosted by a surge in the price of copper. The price of copper rose 14% for the month and hit the highest level since 2022 due to high demand from green energy uses amid tight supply caused by a mine closure. The precious metals index also had a strong return due mostly to the gain for silver which advanced due to increasing industrial demand and the metal’s appeal as an inflation hedge. The petroleum and livestock sub-indices were down modestly due to increased inventories. Vogel Consulting, LLC (Vogel) Tactical Recommendations

It is clear inflation will continue to be a main focus for investors. The resilient labor market is still an inflationary force which could make inflation more sticky than many investors previously expected. Sticky inflation could mean high for longer interest rates that could pressure consumer and business spending and therefore corporate earnings. Markets are likely to be choppy in the near term as investors parse economic data and comments by Fed members and companies for indications about the trends in prices as well as consumer and business activity that will impact interest rates and earnings.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. The strengthening U.S. dollar could be a headwind to returns from foreign equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: