May 08, 2025

Describing equity markets as a roller coaster or as volatile was an understatment in April. The S&P 500 index dropped 12% in four trading days after the “Liberation Day” announcement of larger than expected reciprocal tariffs on most countries and then China’s implementation of steep retalitority tariffs on U.S. goods. The reaction to the tariff developments sent the Nasdaq index down even more and into a bear market (down 20% from the recent peak). Then the S&P 500 posted its biggest one-day gain since 2008 (+9.5%) and the Nasdaq gained 12% after a 90-day pause in most reciprocal tariffs was announced. The next day the index turned lowered again and was down over 3% as  uncertainty returned as the focus for investors. Four days later, the index climbed in a sigh of relief after a tariff exemption was announced for smartphones and various other electronics. Then the index sunk almost 5% after President Trump commented that the termination of Federal Reserve Chair Powell “cannot come fast enough”. The next day, the S&P 500 index started a seven-day run of increases with the index gaining 5%. After all the angst about potential slowing of economic activity and inflationary pressures in reaction to each new headline and the resulting sharp ups and downs, the S&P 500 index ended the month down less than 1%. However, it was the third consecutive negative monthly return. The index of smaller company stocks faired worse than the large capitalization (cap) S&P 500, as is typical in highly volatile periods. International equity markets were also volatile in reaction to the changing tariff situation but outperformed U.S. equity indices. The bond market had plenty of ups and downs too during the month, but most sectors registered gains for the month. Gold rallied sharply and set more record highs on strong government buying and demand for safe haven assets. Oil prices sank on concerns about lower global demand when OPEC+ is increasing production.

uncertainty returned as the focus for investors. Four days later, the index climbed in a sigh of relief after a tariff exemption was announced for smartphones and various other electronics. Then the index sunk almost 5% after President Trump commented that the termination of Federal Reserve Chair Powell “cannot come fast enough”. The next day, the S&P 500 index started a seven-day run of increases with the index gaining 5%. After all the angst about potential slowing of economic activity and inflationary pressures in reaction to each new headline and the resulting sharp ups and downs, the S&P 500 index ended the month down less than 1%. However, it was the third consecutive negative monthly return. The index of smaller company stocks faired worse than the large capitalization (cap) S&P 500, as is typical in highly volatile periods. International equity markets were also volatile in reaction to the changing tariff situation but outperformed U.S. equity indices. The bond market had plenty of ups and downs too during the month, but most sectors registered gains for the month. Gold rallied sharply and set more record highs on strong government buying and demand for safe haven assets. Oil prices sank on concerns about lower global demand when OPEC+ is increasing production.

In economic news, consumer and business sentiment indices declined again fueling market participants’ worries that consumers and businesses will curtail spending and investment and drive a slowdown in economic activity, maybe even a recession, while tariffs will spark rising inflation. Several economists and strategists raised their estimates for the

probability that the U.S. economy to fall into recession. The first estimate of gross domestic product (GDP) didn’t help ease recession worries coming in at an annual rate of -0.3%, the first negative reading since 2022. However, that number reflects a likely one-time spike in imports as businesses attempted to front run the tariff hikes. Offsetting the more pessimistic news were better than expected reports on inflation, jobs, retail sales, home sales, industrial production, and corporate earnings. The consumer price index grew at 2.4% from a year ago down from 2.8% in the prior month. The number of nonfarm payrolls increased by 228,000. Retail sales were up 1.4% from the prior month. New homes sales jumped 7.4%. Industrial production increased at an annual rate of 5.4%. Corporate earnings reports have been generally solid with a majority of companies that have reported so far beating analysts’ estimates.

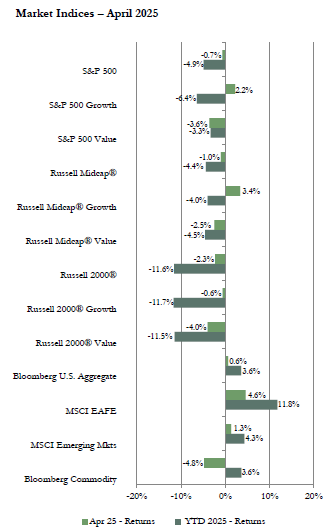

Each of the three U.S. equity market cap segment indices posted a negative return for April. The larger cap index, the S&P 500, had the smallest decline followed by the mid-cap index, which outperformed the small-cap index. Growth outperformed value in each market cap category mostly because technology stocks rallied after the pause in reciprocal tariffs, the exemption for electronics, and strong earnings announcements from major technology companies. Technology was the top performing sector in the S&P 500 and Russell Mid Cap indices and one of the best performing sectors in the Russell 2000 index. Consumer staples had the top sector return in the Russell 2000. The energy sector was the performance laggard posting a double-digit negative return in all three market cap segments reflecting the sharp drop in the price of oil on worries about weakening demand.

Both the MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index posted a positive return on a U.S. dollar basis and outperformed the U.S. equity indices again in April. Currency moves were a boost to the returns for both indices since both had a slight negative return on a local currency basis. The EAFE index was the performance leader. Sector performance in the EAFE was led by the utilities and communications sectors with energy the laggard by posting a sizeable negative return. The consumer staples sector had the highest return among the 11 sectors in the EM index while consumer discretionary had the worst return. On a geographical basis, returns were solid across regions but European countries had the best returns fueled by optimism about increased defense spending as well as positive inflation trends and another interest rate cut by the European Central Bank. In emerging markets, the Latin American index had the top return boosted by the double-digit gain for the Mexican index. Mexican stocks rallied in reaction to the news that the country was excluded from the Liberation Day reciprocal tariffs. At the other end of the performance spectrum, the China index sank and posted a negative return for the month hurt by the escalation in the trade war between China and the U.S.

Most sectors of the U.S. bond market posted positive returns for the month. The primary exceptions were the long dated Treasury and municipal bond indices. Bond prices/yields were highly volatile just as equity markets were in reaction to uncertainty around the potential inflationary impact of Trump administration tariff policies and a brief bout of uneasiness about Trump’s unhappiness with Federal Reserve Chair Powell’s leadership. For example, the benchmark 10-year Treasury bond yield started the month at 4.21% but quickly dropped to 4.01% before shooting up to 4.49% in an unusually quick move on trade war impact worries and signs that China and Japan may be selling Treasury bonds. However, from mid-month on the yield bounced around but trended lower and ended the month at 4.17%. In addition to tariff fueled volatility, prices in the municipal bond segment were pressured by increased supply as bond issuance rose.

The Bloomberg Commodity index had a negative return for April. Prices for a variety of commodities fell during the month on fears of weaker global demand as a result of the escalating trade/tariff war situation. The price of crude oil dropped to a four-year low. West Texas Intermediate (WTI) crude oil fell to about $60 per barrel. WTI was priced at $72 at year-end 2024. Coffee, cocoa, and copper were also all down significantly. The industrial metals and energy sub-indices posted sizeable negative returns. The livestock sub-index had a positive return on tight inventories while the precious metals index had the top sub-index return boosted by the rise in the price of gold on safe haven buying. The price of gold hit a record high of $3,500 per ounce during the month.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

As we have said in the past, the impact of tariffs is a continuing risk to corporate earnings and financial market performance. However, the inflation and growth implications of those tariff actions are uncertain due to the fluid nature of the actions and negotiations. For now, the U.S. economy appears solid enough to withstand the current uncertainty. The labor market is resilient creating above 100,000 new jobs per month with the number of new unemployment claims staying steady at a low level and wage growth slowing but still above the inflation rate. Corporate earnings are likely to slow and analysts have lowered their estimates. However, analysts are still expecting positive earnings growth for 2025. International markets have outperformed the U.S. so far this year and while tariff policies will impact those regions also, stimulus measures and potentially further interest rate cuts may boost economic activity, earnings, and financial markets in those regions. Therefore, diversification across regions and asset classes is likely to be beneficial as global economies and markets navigate and adjust to potentially significant changes to policies and business and consumer reactions to those policies.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: