September 04, 2025

Returns were positive in August for the major asset classes. The announcement of more generally strong corporate earnings to wrap up the second quarter reporting period along with some resilient economic data reports helped drive equity prices higher. Several major equity indices around the world set new record highs during the month including the S&P 500 and Nasdaq in the U.S, the Nikkei 225 in Japan, the Ibovespa in Brazil, and the FTSE 1000 in the United Kingdom. However, Federal Reserve (Fed) related news was perhaps the most significant driver of finanical market returns. At the Fed’s Jackson Hole Symposium, chair Powell commented that the balance of economic risks has shifted based on the latest payroll report that showed a marked slowing. Those comments led to a consensus among market participants that the Fed will likely cut its policy interest rate at its September meeting.  The interest rate cut optimism sent equtiy prices higher especially for cyclical and small-capitalization (cap) stocks. Prices for short-term bonds also rose sending yields lower. The other Fed related news also moved markets. President Trump’s firing of Fed governor Lisa Cook sparked worries about the independence of the central bank that sent yields on longer-term bonds up. The price of gold also rose to new record highs on safe haven demand. Another item of note that occurred during August is that longer-term bond yields in Europe and Japan rose to the highest levels in decades. Investor concerns about the fiscal health of European countries especially France and Germany due to the high cost of social programs and now increasing military spending drove yields up. A confidence vote in early September about the French government’s plans to reduce the budget deficit is expected to fail which will likely lead to near term instability in that government. Long-term bond yields rose in Japan due to the high inflation rate.

The interest rate cut optimism sent equtiy prices higher especially for cyclical and small-capitalization (cap) stocks. Prices for short-term bonds also rose sending yields lower. The other Fed related news also moved markets. President Trump’s firing of Fed governor Lisa Cook sparked worries about the independence of the central bank that sent yields on longer-term bonds up. The price of gold also rose to new record highs on safe haven demand. Another item of note that occurred during August is that longer-term bond yields in Europe and Japan rose to the highest levels in decades. Investor concerns about the fiscal health of European countries especially France and Germany due to the high cost of social programs and now increasing military spending drove yields up. A confidence vote in early September about the French government’s plans to reduce the budget deficit is expected to fail which will likely lead to near term instability in that government. Long-term bond yields rose in Japan due to the high inflation rate.

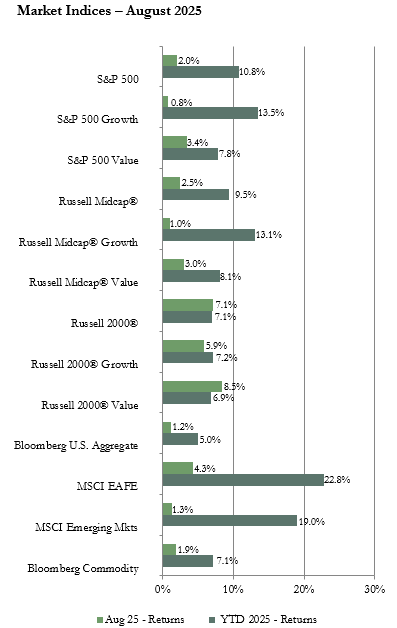

In the U.S. equity market, the small-cap stock indices outperformed the large and mid-cap indices by a wide margin. Various factors contributed to the small-cap outperformance including announcements of buyouts of small-sized companies, expectations for interest rate cuts that will lower financing costs for small businesses, strong demand for precious metals boosting mining stocks, and the lagging performance of large-cap technology stocks as worries about the huge costs versus benefits of spending on artificial intelligence projects resurfaced. Value stocks outperformed growth stocks in the S&P 500, Russell Midcap, and Russell 2000 indices as cyclical and interest rate sensitive stocks rallied on rate cut optimism and technology stocks lagged.

In non-U.S. equity markets, returns were positive for most developed international countries while returns were mixed for emerging markets countries. Therefore, the MSCI EAFE index of developed international equities outperformed the MSCI Emerging Markets (EM) index for the month. The dollar based return for the EAFE index was double the local currency based return since the dollar weakened against European and Japanese currencies. However, there was little difference between the dollar based and local currency returns for the EM index. Sector performance in the EAFE was led by communications and consumer discretionary with technology the laggard. The materials sector had the highest return among the 11 sectors in the EM index while healthcare had the poorest result with a negative return. On a geographical basis, among developed international regions, Japan posted the highest return on better than expected economic growth and strong earnings reports. New Zealand was the worst performing developed international market with a small negative return reflecting the economic slowdown in that country. In emerging markets, the Latin America index was the top performer boosted by the double-digit gains for Brazil and Chile. The major equity indices for Brazil and Chile each set a new record high. Strong inflows from foreign investors boosted the Brazilian market while better than expected gross domestic product growth and rising copper prices drove stock prices higher in Chile. India and South Korea were the laggards among emerging markets with negative returns. Indian stocks fell in reaction to the U.S. imposing 50% tariffs on Indian imports in an attempt to persuade India to stop buying Russian oil. Negative reaction to new tax policy hurt stock prices in South Korea.

All sectors of the U.S. bond market posted positive returns for August except the longest maturity Treasury bond index that was down marginally. The shift in Fed chair Powell’s view that risks to the employment market have risen and so a change in interest rate policy may be prudent lifted most bond prices as yields fell. The benchmark 10-year U.S. Treasury bond yield started the month at 4.37% but declined to end the month at 4.23%. In addition, solid corporate earnings and economic data were positive for credit risks which supported corporate bond prices.

The positive return for the Bloomberg Commodity index for August was driven by gains for each major sub-index except energy. The livestock sub-index was a performance leader again up over 7% boosted by record high prices for beef due to the lowest number of cattle in herds in years. The precious metals sub-index was the second best sub-index we track up over 6% as both gold and silver rose. Silver outpaced gold with a 7% gain driven by both industrial demand and safe haven demand. The energy sub-index was down over 5% as both crude oil and natural gas prices moved lower on expectations for lower demand amid solid production levels.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Our view continues to be that diversification across regions and asset classes is likely to be beneficial as global economies and markets navigate potentially significant changes to policies as well as business and consumer reactions to those policies. Also, valuations continued to be elevated. The impact of tariffs is still highly uncertain even though some agreements have been reached. While having deals in place eases some uncertainty and helps businesses to be able to plan, how the agreed upon tariff rates will flow through to the U.S. inflation rate and to U.S. and foreign corporate earnings is highly uncertain. For now, the U.S. economy appears solid enough to withstand the current uncertainty. However, some cracks are starting to show in the labor market such as that while lay-offs have not spiked it is taking longer for the unemployed to find a new job. The Fed is expected to lower interest rates in September but policy makers and investors will be closely watching inflation and labor market data for clues to the outlook for economic activity and the impact on corporate earnings.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: