January 04, 2024

The rally in financial markets in November fueled by the spike in optimism that interest rate hikes are done and cuts are likely within a few months continued throughout December. The Federal Reserve (Fed) provided a boost to the rally. At its December meeting, the Fed indicated the time may be coming to discuss rate cuts and revised its projection for the fed funds rate at year-end 2024 to 4.6% which was down from the 5.1% projected in the September meeting. The new projection pointed to cuts in the rate totaling three-quarters of a percentage point in 2024. Other central banks also indicated that rate hikes are likely done and cuts may be considered in the coming year. Bond yields dropped (and prices rose) as investors priced in rate cuts in 2024. The 10-year U.S. Treasury bond yield declined to under 4%. The 10-year German bond yield fell to below 2% during the month which was the lowest level of the year. The lower yields helped drive stock prices higher. The S&P 500 index, Nasdaq index, and Dow Jones Industrial Average (DJIA) each hit a new 52-week high in early December and continued to move higher throughout the month. In fact, the DJIA set a new all-time record high and went on to set six more record highs during the month. The STOXX Europe 600 index hit a two-year high. The lower yields also provided a boost to the price of gold. Even though gold had a solid gain for the month, the commodity index posted a negative return since other commodity prices fell, particularly oil which moved to under $70 per barrel for a brief time.

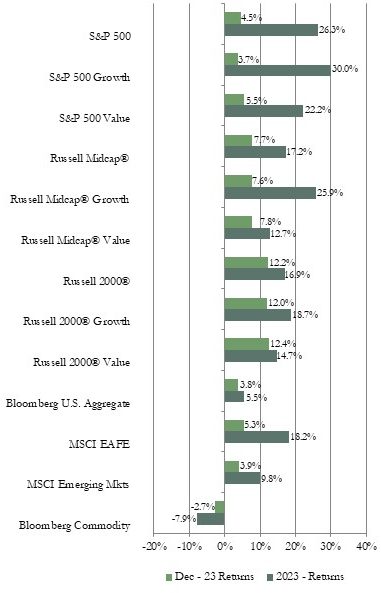

Market Indices – December 2023

The rally also was fueled by economic data that supports the “soft landing” scenario of declining inflation and moderate economic growth in the U.S. The producer price index (PPI) declined to 2% year-on-year growth, the lowest since January 2021. The Fed’s preferred inflation measure, the core personal consumption expenditures index, moved closer to the Fed’s target coming in at 3.2% growth from a year ago down from 3.4% in the prior report. The labor market continues to be resilient. The number of job openings decreased modestly but is still well above prepandemic levels. The number of new jobs in November was above expectations at 199,000 while the unemployment rate declined to 3.7%. Retail sales were up more than expected in November with a 0.3% gain compared to the prior month. Single family housing starts jumped 18% and durable goods orders rose 5.4%, which

was above expectations and the largest increase since July 2020. The Institute of Supply Management’s Purchasing Managers Index (PMI) of Services is solidly in expansion territory and improved to 52.7. However, the manufacturing sector continues to be in contraction territory with the latest Manufacturing PMI report at 46.7. This was the 13th consecutive month with a report under 50, which is the dividing line between expansion and contraction.

The fourth quarter equity rally extended to nine consecutive weeks as major U.S. equity indices advanced throughout December. The S&P 500 index came within one percent of its all-time high set on January 2, 2022. As strong as large-capitalization (cap) stock index returns were, mid and small-cap stock indices gained more. Small-cap stock indices were the top performers with double-digit gains. Value outperformed growth in the large, mid and small-cap categories, though the performance differences were smaller in the mid and small-cap indices. The expectations for lower interest rates fueled gains in technology and other growth stocks as well as in interest rate sensitive stocks. Therefore, real estate, industrials, and communications were top performing sectors in each market cap category. Healthcare was also a top performing sector in the mid and small-cap indices. Energy was the laggard in each market cap category due to falling oil prices. The defensive utilities and consumer staples sectors were also among the weakest performing sectors in the “risk-on” market environment.

Both the MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) posted a positive return for December on a U.S. dollar basis. Dollar based returns were higher than local currency returns for both indices since the dollar declined during the period. Growth outperformed value in the EAFE index but value outperformed growth in the EM index. Sector returns in the EAFE index were similar to results in the U.S. equity indices with cyclical sectors posting the best returns and energy with the lowest return. In contrast, utilities was the best performing sector in the EM index while communications services had the worst return. On a geographical basis, among developed international markets the Pacific ex Japan index had the highest return while the euro region had the lowest return. Among emerging markets, the Latin America index had the best performance. India was also a top performer. China was again one of the weakest performing indices with a negative return as that country reported more disappointing economic data, Moody’s downgraded China’s sovereign debt rating, and the government announced new rules aimed at restricting the online gaming sector.

Returns for all sectors of the U.S. bond market were positive for December reflecting the drop in yields on expectations for rate cuts in 2024. Yields for government bonds declined across the yield curve. The 10-year Treasury bond yield fell to under 4%. (It was just a few weeks earlier in October when the yield went over 5.0%.) Longer-term bond indices had the best returns as yields fell. The yield curve remains inverted. The 3-month Treasury bill yield was 5.4% at the end of December compared to the 2-year Treasury bond yield of 4.2% and the 10-year Treasury bond yield of 3.9%. The drop in bond yields led to a drop in mortgage rates as well. The average 30-year fixed mortgage rate declined to 6.6%, the lowest rates since May. As a reminder the average mortgage rate hit a 23-year high of 7.8% in October.

In contrast to equity and bond indices, the Bloomberg Commodity index had a negative return for December. Just as in November, the main drag on the index return in December was the decline in the energy sub-index. That index was down 6% for the month. Both oil and natural gas prices dropped during the month due to increasing inventories and concerns about slowing demand, particularly from China. The price of West Texas Intermediate crude oil declined to below $70 per barrel during the month but recovered modestly to end December at $71.65 per barrel. That compares to the November month-end price of $75.66. The only sub-index we track that had a positive return for the month was industrial metals with a 4% return

Vogel Consulting, LLC (Vogel) Tactical Recommendations

After the strong rally during the fourth quarter fueled by the exuberance about the potential for lower interest rates possibly as soon as the first quarter of 2024, markets appear to be overbought. Technical indicators including investor sentiment were at overly bullish levels at year-end. Therefore, it would not be surprising if markets retreat somewhat while investors reposition for the new year and assess upcoming earnings reports and economic data. Even though the rate of inflation has come down significantly from peak levels, inflation is likely to continue to be a main focus for investors. The Fed’s preferred inflation measure was up in November and is still above the Fed’s 2% target. The resilient labor market is still an inflationary force which could make inflation more sticky than many investors seem to currently expect. Sticky inflation could mean high for longer interest rates that could pressure consumer and business spending. Therefore, markets may again experience large swings in reaction to clues to the path of interest rates in economic data reports and comments by company executives in earnings reports.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for developed market equities and our underweight for emerging markets equities. Since bond yields are more attractive than they have been in many years, we encourage investors to revisit fixed income allocations. Our fixed income recommendation is for an equal weight position relative to long-term targets. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: