January 07, 2025

The positive momemtum in financial markets in November from robust earnings, expectations for lower interest rates, and optimism about tax cuts and deregulation in the Trump administration carried over for most sectors at the start of December. The S&P 500 index hit its 57th record high for the year on December 6 with the Dow Jones Industrial Average and the Nasdaq also setting new highs. Then things changed. The consumer price index (CPI) report came out and showed that improvement in the rate of inflation seems to have stalled. The core CPI rate was up 3.3% over the prior year for the third consecutive month. About the same time, Federal Reserve (Fed) Chair Powell commented that the Fed could “afford to be a little more cautious” on the pace of rate cuts since the economy appeared to be stronger than in September when the Fed began to reduce interest rates. Finanical markets reacted negatively to both the CPI report  and Powell’s comments on higher interest rates for longer. The pull back in stock prices and the jump in bond yields deepened after the hawkish rate cut by the Fed at its meeting on the 18th. The Fed did reduce its fed funds rate by a quarter percentage point as expected but its new projections pointed to fewer cuts in 2025 and 2026 than previously expected. The new projections point to only two cuts in 2025 down from the previous estimate of four. The sell-off was broad. All sectors of the equity market declined sharply. The typical Santa Claus rally in the last few days of the year did not occur in 2024. Government bond yields rose (and prices fell) to the highest levels since May. The higher yields led to the dollar rising to the highest level since 2022. Outside the U.S., European stocks also fell during the month hurt by the hawkish Fed comments, weak economic data reports, and concerns about weakening trade with China. Chinese stocks advanced modestly in December in reaction to announcements of more stimulus to come. Gold traded lower in reaction to higher bond yields and the strengthening dollar.

and Powell’s comments on higher interest rates for longer. The pull back in stock prices and the jump in bond yields deepened after the hawkish rate cut by the Fed at its meeting on the 18th. The Fed did reduce its fed funds rate by a quarter percentage point as expected but its new projections pointed to fewer cuts in 2025 and 2026 than previously expected. The new projections point to only two cuts in 2025 down from the previous estimate of four. The sell-off was broad. All sectors of the equity market declined sharply. The typical Santa Claus rally in the last few days of the year did not occur in 2024. Government bond yields rose (and prices fell) to the highest levels since May. The higher yields led to the dollar rising to the highest level since 2022. Outside the U.S., European stocks also fell during the month hurt by the hawkish Fed comments, weak economic data reports, and concerns about weakening trade with China. Chinese stocks advanced modestly in December in reaction to announcements of more stimulus to come. Gold traded lower in reaction to higher bond yields and the strengthening dollar.

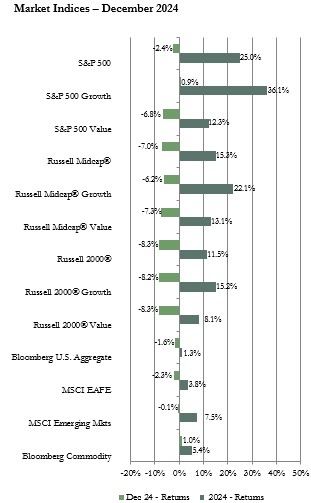

U.S. equity market indices posted negative returns for December with the exception of the S&P 500 Growth index that was boosted by the renewed optimism for the large artificial intelligence (AI) related stocks. The broad index of larger capitalization (cap) stocks, the S&P 500, ended with a modest negative return after starting the month setting a new record high. Small and mid-cap stock indices declined more. The shift to the “higher for longer” interest rate outlook pressured small and mid-cap stocks more than larger-cap stocks. Growth outperformed value in each market cap category but the performance gap was wider in the large-cap category than in the mid-cap category and there was only a small difference in the small-cap category. From a sector perspective, AI related stocks boosted the information technology and communications sectors to the top of the performance rankings for the month. Strong holiday retail and e-commerce sales resulted in the consumer discretionary sector also being a top performer for the month. At the other end of the performance rankings, materials was the poorest performing sector pressured by concerns about the rate of global economic growth, particularly in China.

In international market news, the European Central Bank, the Riksbank of Sweden, and the Bank of Canada along with others cut interest rates to support their economies since economic data has been weak and inflation is nearing target. However, Brazil raised its key rate by a full percentage point due to a pick-up in inflation. The Chinese government announced a shift to looser monetary policy will be coming in 2025 after more reports of deflationary pressures in that economy and the purchasing managers index of services activity was down more than expected.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index each had a negative return for December. Equity prices in Europe were pressured by concerns about slowing economy activity and concerns about potential policy changes in the U.S. under the new administration, such as tariffs and restrictions on pharmaceuticals. Among EM markets, Greece was the top performing country reflecting the economic turnaround occurring there. Taiwan was another performance leader boosted by strength in semiconductor and AI related stocks. Brazil was the performance laggard as stock prices reacted negatively to the interest rate hike. The South Korean market was another laggard due to political turmoil in that country. U.S. dollar based returns for the EAFE and EM indices were lower than local currency returns since the dollar was up sharply after the Fed projections pointed to fewer interest rate cuts in the next two years. The stronger dollar was especially negative for the EAFE index.

All sectors of the U.S. bond market posted negative returns for December except the shortest maturity government and corporate bond indices. The shortest maturity bond yields moved down slightly with the fed funds rate cut. However, despite the quarter percentage point rate cut, yields for intermediate and long-term bonds moved up (and bond prices moved down) after strong economic data reports, sticky inflation reports, and Fed member comments suggesting there is no need to rush into further interest rate cuts created worries that interest rates may stay higher for longer than anticipated just weeks ago. For example, the 10-year Treasury bond yield ended the month at 4.6% up from 4.2% at the end of November.

The Bloomberg Commodity index had a small positive return for December driven by gains in the petroleum and agriculture sub-indices. The petroleum sub-index was the performance leader with a gain of over 5%. The price of West Texas Intermediate crude oil jumped to end December at $72.44 up from $68.26 at the end of November due to tight supply. The agriculture index return was boosted by the price of coffee and cocoa each hitting record highs due to weather issues. Prices for precious and industrial metals dropped in reaction to the stronger dollar and higher long-term bond yields.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Much of the U.S. economic data continues to show resilience despite the higher interest rates from the Fed’s fight against inflation. The labor market has cooled which bears watching for clues to the health of the consumer, but unemployment remains low, wages continue to move up, and the number of job openings remains above prepandemic levels. The solid labor market has been supporting the all-important consumer spending side of the economy. However, there is a risk that the effect of higher for longer interest rates could spread beyond the housing, auto, and manufacturing sectors given the Fed’s revised projections for fewer rate cuts in 2025 and 2026 and the potential for trade and tariff policies to boost prices for a variety of goods. Outside the U.S., inflation is near central bank targets. Now the focus is on growth and the picture is mixed with services outpacing manufacturing. However, indications are that central banks will make additional interest rate cuts to support economic activity. Given the stronger growth data in the U.S. compared to various developed and emerging markets, the uncertain impact of Trump administration tariffs and trade policy on foreign economies, and the likelihood that the U.S. dollar will continue to be strong, our recommendation to be underweight non-U.S. stocks and equal weight to U.S. stocks remains in place. Major U.S. equity indices posted double-digit gains for two consecutive years. Various widely followed analysts are forecasting another double-digit gain for the S&P 500 in 2025 boosted by solid earnings growth, benefits of AI, and further interest rate cuts. However, valuation levels are high particularly for U.S. large-cap stocks. The high valuation levels increase the risk of heightened volatility due to unexpected earnings, economic, or geopolitical news. We retain the recommendation for an overweight to cash reserves.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We recommend a neutral weight position in U.S. equities and an underweight in international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: