February 06, 2025

Each of the major asset classes we track generated a positive return in January, although it was not a smooth path to those positive returns. Financial markets zigged and zagged, sometimes quite sharply, as investors reacted to strong economc data and proposals by the Trump administration that fueled inflation and therefore higher for longer interest rate concerns, strong earnings reports, artificial intellignence (AI) disruptor news, tariff talk, and other news.

Strong jobs reports early in the month, which showed job openings rose to 8.1 million and nonfarm payrolls rose 256,000, both above expectations, sent bond yields up and equity prices down. The 10-year Treasury bond yield rose to 4.8%, the highest in  over a year and the 30-year Treasury yield rose to almost 5%, a two-year high. All the “Trump bump” gains in the equity market after the election were erased since the strong job data and higher yields pushed back expectations for the next Federal Reserve interest rate cut until mid-year at the earliest. In mid-month, a cooler than expected inflation report, strong earnings reports from major banks, and the anticipation of a business friendly administration with the inauguration of Trump fueled a stock market rally that sent the S&P 500 index to a new all-time high. Late in the month, news about a new AI model from Chinese company DeepSeek sent markets into a frenzy. For example, the Nasdaq index dropped 3% on the day the news came out that the DeepSeek model was developed at a fraction of the cost of other models such as ChatGPT. Stock markets declined since the news brought into question the potential return on the vast amount of spending being done on AI. AI, semiconductor, cloud, data center, and power producer stocks all moved dramatically lower on the uncertainty created by the DeepSeek news. Bond yields fell while gold and defensive stock prices rose on safe haven trading. Gold hit a new record high. Markets partially reversed as questions about DeepSeek’s claims percolated and investors “bought the dip” after the sell-off. Markets reversed yet again to end the month as the White House said tariffs on Mexico, Canada, and China would be implemented February 1.

over a year and the 30-year Treasury yield rose to almost 5%, a two-year high. All the “Trump bump” gains in the equity market after the election were erased since the strong job data and higher yields pushed back expectations for the next Federal Reserve interest rate cut until mid-year at the earliest. In mid-month, a cooler than expected inflation report, strong earnings reports from major banks, and the anticipation of a business friendly administration with the inauguration of Trump fueled a stock market rally that sent the S&P 500 index to a new all-time high. Late in the month, news about a new AI model from Chinese company DeepSeek sent markets into a frenzy. For example, the Nasdaq index dropped 3% on the day the news came out that the DeepSeek model was developed at a fraction of the cost of other models such as ChatGPT. Stock markets declined since the news brought into question the potential return on the vast amount of spending being done on AI. AI, semiconductor, cloud, data center, and power producer stocks all moved dramatically lower on the uncertainty created by the DeepSeek news. Bond yields fell while gold and defensive stock prices rose on safe haven trading. Gold hit a new record high. Markets partially reversed as questions about DeepSeek’s claims percolated and investors “bought the dip” after the sell-off. Markets reversed yet again to end the month as the White House said tariffs on Mexico, Canada, and China would be implemented February 1.

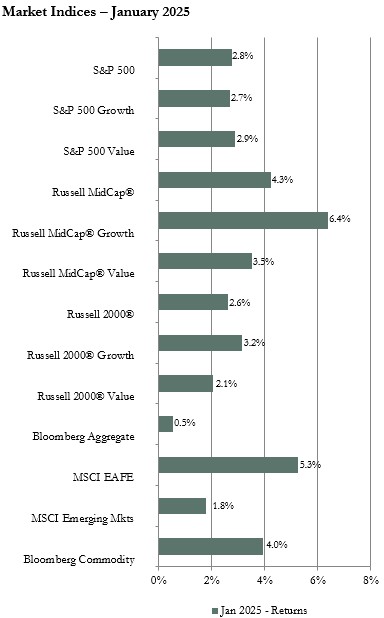

In the U.S. equity market, the Russell Mid-Cap index outperformed the S&P 500 and the Russell 2000 index. The growth sub-index of the mid-cap index outperformed the value sub-index by a wide margin since the technology sector had the top sector result boosted by double-digit gains for several positions. Growth also outperformed value in the Russell 2000 index even though the technology sector had one of the weakest returns among the 11 sectors in the index. Healthcare was the top performing sector in the small-cap index as both biotechnology and health services companies posted strong gains. In contrast to the mid and small-cap indices, value outperformed growth in the S&P 500 index. The value sub-index return was boosted by the over 6% return for the financials sector in reaction to better than expected major bank company earnings. On the growth side of the index, the communications sector generated a 9% return, boosted by double-digit gains for positions such as Netflix and Meta Platforms. However, the largest weighted sector at about a third of assets, the technology sector, was a drag on the return since it generated a negative return for the month due to the pressure on AI related stocks in the DeepSeek related sell-off.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) had a positive return for the quarter. Since the value of the U.S. dollar declined during the month, the U.S. dollar based returns were modestly higher than the local currency based returns. The EAFE index outperformed the S&P 500 and the EM index. Growth stocks outperformed value stocks in both the EAFE and the EM. In contrast to the S&P 500 where the technology sector was the performance laggard, in the EAFE and EM technology was one of the top performing sectors . Communications had the best return in the EAFE index while materials was the top performer in the EM index. Utilities was the laggard among the 11 sectors in both the EAFE and EM indices. On a geographical basis, among developed international markets, Europe outperformed the other regions by a wide margin, helped by improving macroeconomic data such as the fifth consecutive month of higher retail sales and optimism for additional interest rate cuts fueled by softer inflation data. The STOXX 600 index of European stocks and the UK’s FTSE 100 index both hit a new record high during the month. Japan was one of the weakest performing developed international countries due to rising inflation leading the Bank of Japan to raise interest rates to the highest level in 17 years. In emerging markets, Latin America was the top performing region boosted by a double-digit gain for Brazil, which was a laggard in 2024. China had a modest positive return in large part due to some softening in the tariff threats from the Trump administration. India was one of the weakest performing EM countries posting a negative return due to disappointing earnings and economic reports.

All sectors of the U.S. bond market posted modest positive returns. Despite significant movement in yields up and down during the month in reaction to economic and government policy news, yields across the maturity curve ended the month little changed from the end of December. The spread between the yield on corporate and government bonds tightened in January. Therefore, the corporate high yield bond index had the best sector return.

The Bloomberg Commodity index had a positive return for January and outperformed the S&P 500 and the EM indices. Each of the sub-indices we track also had a positive return. The precious metals sub-index had the top return of over 7% as the price of both gold and silver rose sharply in safe haven trading as investors fretted over the AI disruptor and tariff news. The agricultural sub-index was also strong. The price of cattle and beef hit record highs in the first part of the month due to tight supply.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Financial markets always face uncertainty. However, uncertainty seems to be elevated for the time being. Broadly speaking, corporate fundamentals are solid with companies across industry sectors reporting strong earnings growth. While economic conditions vary by region, economic growth is expected to be positive in most regions and additional interest rate cuts could boost activity in currently slower growing regions. Further, in the U.S., policy changes such as tax cuts and deregulation could also provide a boost to business confidence, spending, and acquisition activity that could drive corporate earnings higher. However, there are several risks that have been, and are likely to continue to, cause bouts of volatility. Inflation remains top of mind for market participants with inflation rates proving to be more sticky than previously expected. The possible impacts of new or higher tariffs amplify the risk of inflation. The possibility of more and higher tariffs is also amplifying risks to economic growth and corporate earnings. However, as events of recent days show, it is very difficult to gauge the impact of tariffs since policy decisions are fluid with changes day-to-day or even intraday. With valuations high across asset classes, markets are vulnerable to disappointing news on tariffs, economic data, earnings, or interest rates. Therefore, we see value in diversification by owning assets with varying growth and value characteristics, market capitalization size, and geographic location.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We recommend a neutral weight position in U.S. equities and an underweight in international developed and emerging markets equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: