July 02, 2024

June could best be described as a mixed month for financial markets, monetary policy, and economic reports. For example, the S&P 500 and Nasdaq indices set several new record highs, but small company stock indices posted negative returns. The emerging markets equity index showed a gain for the month, however, the developed international equity index declined. Bond returns were positive while most commodity index returns were negative. The U.S. Federal Reserve (Fed) and the Bank of England left their policy interest rates unchanged while the European Central Bank, the Bank of Canada, and the Swiss National Bank each lowered their rate by a quarter of a percentage point. Inflation reports came in better than expected but housing sales, starts, and new permits each dropped sharply.

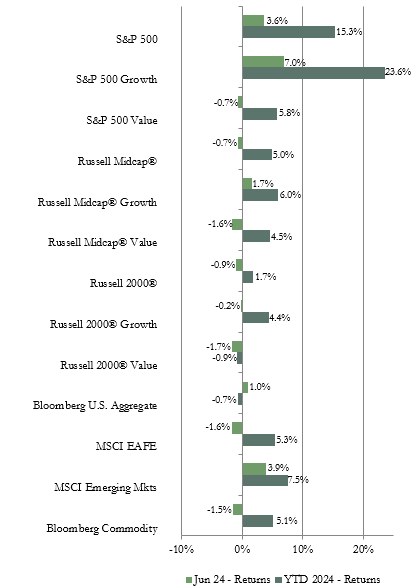

Market Indices – June 2024

In U.S. equity markets, the S&P 500 index hit multiple new record highs in June driven by gains in artificial intelligence (AI) frenzy related technology (tech) stocks. NVIDIA was up 37% for the month and briefly became the highest valued publicly traded company in the world due to huge demand for its AI processors. Broadcom was up 22% on strong demand for its semiconductors. Apple, Inc. gained 23% boosted by the introduction of its new Apple Intelligence system to deliver personalized AI in users’ private clouds. However, signs that macroeconomic data is slowing pressured cyclical and smaller size company stocks. So, while the S&P 500 index had a positive return for June, the Russell Midcap and Russell 2000 indices each had a negative return and growth indices outperformed value indices. Given the AI frenzy, the tech sector was the best performing sector in the large and mid-capitalization (cap) indices. The performance differential between the tech sector and the 10 other industry sectors was particularly wide in the S&P 500 index. The tech sector in the S&P 500 had a return of 9.3% with the next best performance being the 4.9% return for the consumer discretionary sector. At the other end of the performance spectrum, the utilities sector was down over 5%. Communication services had the top return in the Russell 2000 index of small sized companies. The materials sector was a particularly weak performer in June with a negative return in each market cap segment hurt by the drop in precious and industrial metals prices due to weakening demand.

In U.S. equity markets, the S&P 500 index hit multiple new record highs in June driven by gains in artificial intelligence (AI) frenzy related technology (tech) stocks. NVIDIA was up 37% for the month and briefly became the highest valued publicly traded company in the world due to huge demand for its AI processors. Broadcom was up 22% on strong demand for its semiconductors. Apple, Inc. gained 23% boosted by the introduction of its new Apple Intelligence system to deliver personalized AI in users’ private clouds. However, signs that macroeconomic data is slowing pressured cyclical and smaller size company stocks. So, while the S&P 500 index had a positive return for June, the Russell Midcap and Russell 2000 indices each had a negative return and growth indices outperformed value indices. Given the AI frenzy, the tech sector was the best performing sector in the large and mid-capitalization (cap) indices. The performance differential between the tech sector and the 10 other industry sectors was particularly wide in the S&P 500 index. The tech sector in the S&P 500 had a return of 9.3% with the next best performance being the 4.9% return for the consumer discretionary sector. At the other end of the performance spectrum, the utilities sector was down over 5%. Communication services had the top return in the Russell 2000 index of small sized companies. The materials sector was a particularly weak performer in June with a negative return in each market cap segment hurt by the drop in precious and industrial metals prices due to weakening demand.

In foreign equity markets, the MSCI EAFE index of developed international equities posted a modest negative return while the MSCI Emerging Markets index (EM) had a positive return. The U.S. dollar strengthened during the month, so the U.S. dollar based returns were lower than the local currency based returns for both the EAFE and EM. Growth stocks outperformed value in both indices. Tech was the top performing sector in both indices while materials had the weakest returns. On a geographical basis, among developed international markets, the Pacific ex Japan index had the top regional return led by a positive return for Australia. The Euro Area index had a negative return since equity markets in several countries reacted poorly to the outcome of European Parliament elections and the snap decision by French President Macron to call for elections in late June. In emerging markets, China had another negative monthly return as the boost from government stimulus measures faded. Taiwan was the top performing EM country due to strength in semiconductor stocks. India and South Korea were other top performing countries. The Latin America index again was weak dragged down by a negative return in Brazil, Chile, and Mexico. The Mexico index was down over 10% for the month in reaction to the results of the presidential election and worries that the new president will work to dismantle constitutional checks on executive power.

U.S. bond market sector returns were positive for June. Yields declined modestly in reaction to certain data pointing to downside risks to economic growth and to lower than expected growth in inflation which boosted optimism that the Fed could cut interest rates in September. In the declining yield environment, longer time to maturity bonds had the largest returns. Treasury bond indices outperformed corporate bond indices, but the mortgage-backed securities and municipal bond indices had the highest bond market sector returns. Reflecting lower Treasury bond yields, the average 30-year mortgage rate declined each week during the month and was 6.86% at month-end according to Freddie Mac.

The Bloomberg Commodity index had a negative return for the month. Most of the sub-indices we track recorded a negative return. The main exception was the energy sub-index that was up 6% as oil prices spiked due to increasing geopolitical tensions in Europe and the Mideast. The industrials metals sub-index fell 5% due in large part to the steep drop in the price of copper. Copper inventories hit a four-year high which pushed the price down from the record set in May. Silver also reversed course in June declining about 6% after double-digit gains in prior months. The grains sub-index was down 11% due to better rains in various regions around the world improving the harvest outlook along with better than expected early harvest results in the U.S.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

It is clear inflation and the outlook for interest rate cuts will continue to be a main focus for investors. The resilient labor market is still a main inflationary force even though there has been a slight cooling in the number of new jobs added and wage growth. Therefore, inflation could be sticky. Sticky inflation could mean high for longer interest rates that could dampen economic activity and increase costs, and therefore pressure corporate earnings. The impact of sticky inflation and high interest rates is showing in certain economic data, such as lackluster retails sales, a manufacturing activity index remaining in contraction territory, housing starts and building permits down to the lowest levels since the period of pandemic shutdowns, and credit card and auto loan delinquencies rising. Markets are likely to be choppy in the near term in reaction to each economic data report or Fed member comment that changes the outlook for rate cuts or economic activity.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. The U.S. dollar is likely to continue to strengthen due to the interest rate differential as other countries are starting to cut interest rates, but the Fed is not. A strong dollar could be a headwind to returns from foreign equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment

Print: Download PDF:

Download PDF: