July 08, 2025

All sectors of global financial markets posted positive returns in June. Shrugging off government policy and geopolitical worries, equity markets refocused on the robust growth potential for artificial intelligence (AI) related businesses and the boost to defense and infrastructure related companies from recently passed government stimulus programs. In the U.S., the S&P 500 and Nasdaq composite indices retraced the entire drop to near bear market territory in April after higher than expected level of tariffs were announced on Liberation Day. The U.K. FTSE 100 index also hit a new record high in June. Bond markets were driven higher by positive reaction to easing inflation data and interest rate cuts by several central banks including the European Central Bank (ECB). Gold and oil prices rose after Israel launched airstrikes at Iranian nuclear capabilites.

In economic news, data continued to be mixed. In the U.S., the month started with another better than expected jobs report. Job openings rose to 7.4 million, payrolls increased by 139,000, and wages grew by 3.9% from the prior year. The consumer price index (CPI) came in at a better than expected 2.4% year-over-year increase. However, housing starts were down 9.8% from the prior month to a five-year low, and surprisingly, the Institute for Supply Management’s service activity index fell into contraction territory at 49.9 (less than 50 indicates a contraction) with a sharp drop in new orders. Outside the U.S, the euro area CPI came in below expectations and under the ECB’s target at 1.9% year-over-year growth in contrast to Japanese core inflation which reached a two-year high of 3.3%. The euro area composite purchasing manager’s index (PMI) was stable at 50.2 with improvement in services activity but slowing in manufacturing. In China, the Caixin manufacturing PMI fell into contraction territory at 48.3 from 50.4 in the prior month reflecting the impact of U.S. tariffs.

In economic news, data continued to be mixed. In the U.S., the month started with another better than expected jobs report. Job openings rose to 7.4 million, payrolls increased by 139,000, and wages grew by 3.9% from the prior year. The consumer price index (CPI) came in at a better than expected 2.4% year-over-year increase. However, housing starts were down 9.8% from the prior month to a five-year low, and surprisingly, the Institute for Supply Management’s service activity index fell into contraction territory at 49.9 (less than 50 indicates a contraction) with a sharp drop in new orders. Outside the U.S, the euro area CPI came in below expectations and under the ECB’s target at 1.9% year-over-year growth in contrast to Japanese core inflation which reached a two-year high of 3.3%. The euro area composite purchasing manager’s index (PMI) was stable at 50.2 with improvement in services activity but slowing in manufacturing. In China, the Caixin manufacturing PMI fell into contraction territory at 48.3 from 50.4 in the prior month reflecting the impact of U.S. tariffs.

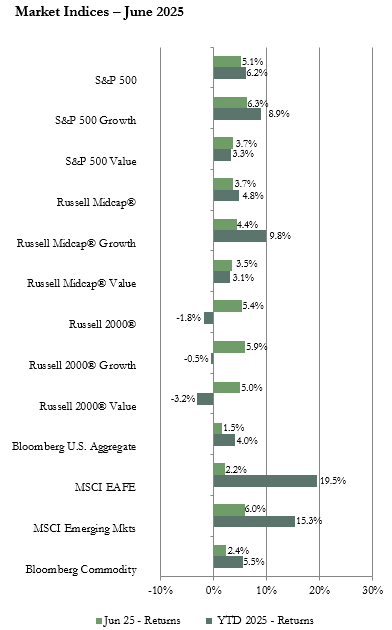

In the U.S. equity market, each of the three market capitalization (cap) segment indices posted a positive return for June. Reinvigorated enthusiasm for AI related and technology stocks fueled much of the equity market advance after positive new product, sales, and earnings reports. Therefore, growth outperformed value across the broad equity market. Technology and communications were the top performing sectors in each market cap segment. With the risk-on sentiment prevailing during much of the month, defensive sectors lagged. The consumer staples sector, with a negative return, had the lowest sector return in the large, mid, and small-cap categories.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets (EM) index each posted a positive return for June. The EM index outperformed the S&P 500 index as well as the EAFE. Due to a sharp drop in the value of the U.S. dollar, dollar based returns were higher than local currency returns for both the EAFE and EM. Sector performance in the EAFE was led by the energy sector while the consumer discretionary sector was the laggard. In the EM index, the technology sector had the top return boosted by the rebound in AI enthusiasm while consumer staples posted the lowest sector return in the risk-on sentiment market. On a geographical basis, returns were positive across developed international and emerging market countries with a few exceptions. Portugal and Israel had the best returns among developed international countries while South Korea and Turkey were the top performing in emerging markets. The South Korean stock market rose after the election of a new president who promised economic reforms.

All sectors of the U.S. bond market generated a positive return for the month due in large part to easing inflationary pressure fueling expectations for an interest cut by the Federal Reserve soon. The shortest-term Treasury bill yields were little changed since the Federal Reserve left the fed funds rate unchanged at its June meeting. However, yields for all other maturities moved lower. The benchmark 10-year Treasury bond yield started the month at 4.41% and ended the month at 4.24%. Inflows into corporate and municipal bond sectors were solid, which further supported price gains in those sectors. The average 30-year fixed mortgage rate declined modestly to a three-month low of 6.8% according to Freddie Mac.

The Bloomberg Commodity index had a positive return for June with each of the sub-indices we track, except the agriculture sub-index, posting a gain. The agriculture sub-index was dragged down by lower grain prices due to favorable weather conditions. The petroleum index had the top return up almost 9%. Crude oil prices spiked over 20% on fears that oil traffic could be disrupted through the Strait of Hormuz during the Israel/Iran conflict but dropped from the peak when the cease fire was announced. The industrial metals sub-index also posted a strong return boosted by the over 7% increase in the price of copper due to tariff concerns causing supply tightness as buyers looked to increase inventories.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Our view continues to be that diversification across regions and asset classes is likely to be beneficial as global economies and markets navigate potentially significant changes to policies as well as business and consumer reactions to those policies. Also, valuations have ratcheted higher again after the tariff induced pullback early in the second quarter. The impact of tariffs is still highly uncertain with time running out on President Trump’s 90-day pause on Liberation Day tariff rates to allow for negotiations. Mr. Trump has commented that deals are coming, but with which countries and at what terms is still uncertain. While having deals in place would ease some uncertainty and help businesses to be able to plan, how the agreed upon tariff rates will flow through to the U.S. inflation rate and to U.S. and foreign corporate earnings is highly uncertain. For now, the U.S. economy appears solid enough to withstand the current uncertainty. The labor market has been resilient creating above 100,000 new jobs per month with the number of new unemployment claims staying steady at a low level and wage growth slowing but still above the inflation rate. However, some cracks are starting to show in the labor market such as that while lay-offs have not spiked it is taking longer for the unemployed to find a new job. The Federal Reserve is in a wait and see mode before loosening monetary policy by lowering interest rates. Corporate earnings are likely to slow and analysts have lowered their estimates. However, analysts are still expecting positive earnings growth for 2025. International markets have outperformed the U.S. so far this year and while tariff policies will impact those regions also, stimulus measures and potentially additional interest rate cuts may boost economic activity, earnings, and financial markets further in those regions.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: