June 06, 2024

After declining sharply in April, major equity indices rebounded in May but there were bouts of volatility. Equity markets had a boost early in the month from data showing a modest slowdown in the job market that stoked expectations that inflationary pressures are easing enough to convince the Federal Reserve (Fed) to lower interest rates. For example, wage growth was 3.9% year-over-year, the slowest rate since June 2021, and the number of new jobs added at 175,000 was down to the lowest in six months. Another boost came in mid-month when a better than expected consumer price inflation report fueled expectations for an interest rate cut and sent the Dow Jones Industrial Average, the S&P 500 index, and the Nasdaq index to new record highs. The STOXX 600 in Europe and the FTSE 100 in the United Kingdom also set new record highs. The Nasdaq index went on to set more highs later in the month on strong semiconductor earnings reports and artificial intelligence (AI) optimism. However, other equity indices retreated when Fed member comments cast doubt on the outlook for a rate cut in the near future. The bond market had a similar pattern during the month. After reaching multi-month highs in April, yields fell (and prices rose) in mid-month after the softer inflation report. However, yields quickly turned up again (and prices went down) and approached the recent highs in reaction to Fed member comments. Yields eased again at month-end after the Fed’s preferred inflation gauge report came in as unchanged from the prior month.

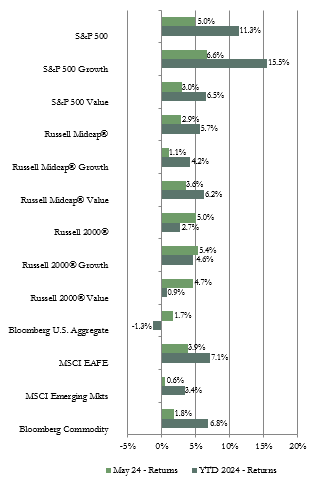

Market Indices – May 2024

The S&P 500, Russell Midcap, and Russell 2000 indices each posted a positive return for the month. The large capitalization (cap) S&P 500 and the Russell 2000 index of small-cap stocks had similar returns and outperformed the mid-cap index. Growth outperformed value in the large and small-cap indices since information technology and communication services were the top performing sectors respectively with double-digit gains in large part due to AI optimism. Value outperformed growth in the mid-cap index. Utilities was the top performing sector in the mid-cap index, also due to expectations for a boost from AI applications since AI data centers are huge users of electricity. Energy was the weakest performing sector in the S&P 500 reflecting the drop in oil prices, while healthcare and financials had the lowest returns in the mid and small-cap indices respectively.

Both the MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) had a positive return for May. The U.S. dollar weakened during the month so, the U.S. dollar based returns were higher than the local currency based returns for both the EAFE and EM. Value stocks outperformed growth in both indices. Utilities was the top performing sector in both indices while energy and healthcare had the weakest returns in the EAFE and EM respectively. On a geographical basis, among developed international markets, the Europe index outperformed the Pacific and Asia regional indices. Europe continued to benefit from booming tourism especially in southern countries. China, with a positive return, performed better than many emerging market countries on optimism that new government stimulus measures will stabilize the distressed property and consumer spending sectors of that economy. Taiwan was a top performing EM country due to strength in semiconductor stocks. Despite strength in the equity market in Chile, the Latin America index again was weak dragged down by a negative return in Brazil and Mexico due to worries about government policy actions and political issues.

U.S. bond market sector returns were mostly positive for May. Yields were volatile during the month in reaction to changing inflation and rate cut expectations but ended modestly lower (and bond prices higher). For example, the 10-year Treasury bond yield declined from a multi-month high of 4.7% in April to 4.3% in mid-May but rose to 4.6% near month-end as the higher for longer rate outlook gained momentum. However, yields dipped to end the month at 4.5% after the personal consumption expenditure deflator inflation gauge came out in line with expectations and was unchanged from the prior month. Since yields mostly moved lower, longer time to maturity bonds had the largest returns. Heavy supply of newly issued bonds pressured municipal bond prices modestly and that index posted a small negative return for the month. The average 30-year mortgage rate began the month near 7.2%, dipped to 6.9%, but ended the month just over 7%.

The Bloomberg Commodity index had a positive return for May. The price of oil fell for the second straight month and hit a three-month low due to rising inventories but other commodities, such as wheat, orange juice, natural gas, and silver had strong price gains. Each of the sub-indices we track, except livestock and petroleum, posted a positive return. The grains and precious metals sub-indices had the top returns. Grain prices rose sharply due to worries about unfavorable growing conditions in the U.S., Europe, and Russia. Silver had another double-digit gain in May due to the metal’s appeal as an inflation hedge.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

It is clear inflation and the outlook for interest rate cuts will continue to be a main focus for investors. The resilient labor market is still a main inflationary force even though there has been a slight cooling in the number of new jobs added and wage growth. Therefore, inflation could be sticky. Sticky inflation could mean high for longer interest rates that could dampen economic activity and increase costs, and therefore pressure corporate earnings. Markets are likely to be choppy in the near term in reaction to each economic data report or Fed member comment that changes the outlook for rate cuts or economic activity.

Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. We retain our neutral weight position recommendation for U.S. equities and our underweight recommendation for international developed and emerging markets equities. The U.S. dollar is likely to continue to strengthen due to the interest rate differential as other countries are starting to cut interest rates but the Fed is not. A strong dollar could be a headwind to returns from foreign equities. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: