December 07, 2023

The turn of the calendar page ushered in a swift shift in investor sentiment after three consecutive negative months for financial market returns. A spike in optimism that interest rate hikes are done and cuts are likely within a few months sparked a sharp rally in stocks, bonds, and foreign currencies during November. The sentiment shift occurred at the beginning of the month when the employment report came in softer than expected. The number of new jobs added missed expectations by 30,000 and the prior month’s report was revised sharply lower. The unemployment rate moved up to 3.9%. Importantly for inflation expectations, the average hourly earnings growth rate slowed to 4.1% over the prior year, the slowest growth rate in two-years. Also, the U.S. Treasury announced it will slow the pace of issuance of longer dated bonds. Bond yields declined on the news which provided a further boost to equity prices. More fuel for the rally came during the month

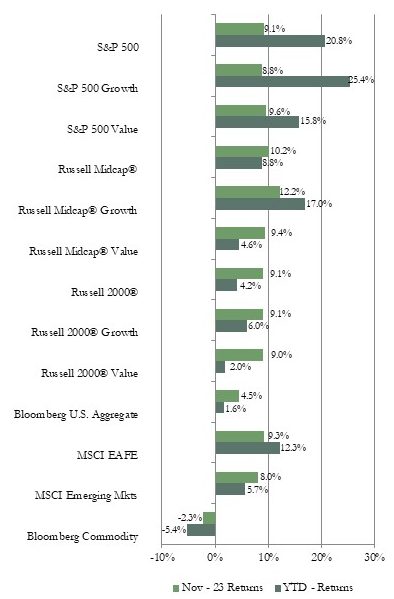

Market Indices – November 2023

with cooler than expected inflation reports. The consumer price index (CPI) came in flat from the prior month and core CPI rose less than expected and hit a two-year low. In addition, the Federal Reserve’s (Fed) preferred inflation measure, the core personal consumption expenditures price index (PCE), showed continued progress toward the Fed’s 2% goal with a report of 3.5% year-over-year growth. The better news on inflation was not limited to the U.S. Inflation reports from Europe came in better than expected with the euro area CPI declining to 2.9% year-over-year growth, the slowest rate since July 2021. The optimism for rate cuts by the Fed and the European Central Bank perhaps as soon as March 2024 proliferated despite comments from central bankers that it is too early to consider interest rate cuts with inflation still above targets. Investors seemed to overlook risks to asset prices from a potential global economic slowdown despite several weak data reports on global manufacturing activity, U.S. housing market activity, and Chinese exports.

U.S. equity markets rebounded strongly in November after falling into correction territory in October. The Dow Jones Industrial Average reached the highest level of the year late in November. Large, mid, and small-capitalization (cap) stock indices each gained about 9% or more with the mid-cap index leading with a return of over 10%. Value outperformed growth in the S&P 500 index but growth outperformed value in

the mid and small-cap indices. Information technology was the best performing sector in each market cap category on strong earnings reports and lower interest rates. Interest rate sensitive sectors, such as real estate, financials, and consumer discretionary were other top performing sectors. Energy had the lowest sector return across the market cap spectrum due to the drop in oil and gas prices and weak demand. Defensive sectors, such as utilities and consumer staples were also at the bottom of the performance rankings in the “risk-on” market environment.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) also posted strong returns for November on a U.S. dollar basis. The declining dollar provided a significant boost to returns from foreign assets this month. The growth index outperformed the value index in both the EAFE and EM indices. Sector returns in the EAFE and EM were similar to results in the U.S. equity indices with information technology the top performing sector and energy posting the lowest return. On a geographical basis, among developed international markets, the euro area had the highest return while the Pacific ex Japan region had the lowest return reflecting continued weakness in the Hong Kong equity market. Among emerging markets, the Latin America index had the best performance with a double-digit gain. The Brazil, Chile, and Mexico indices each posted a double-digit return. Thailand had the weakest return among emerging market country indices followed by the China index which continued its weak streak as that country reported more disappointing economic data.

U.S. bond market sector returns were positive for November reflecting the sharp drop in yields on expectations for rate cuts in 2024. Yields for government bonds declined across the yield curve. The drop in government bond yields was unusually large in a short time period. The 10-year Treasury bond yield fell to 4.4% after reaching 5.0% in October. Longer-term bond indices had the best returns as yields fell. The yield curve remains inverted. The 3-month Treasury bill yield was 5.6% at the end of November compared to the 2-year Treasury bond yield of 4.7% and the 10-year Treasury bond yield of 4.4%. The drop in bond yields led to a drop in mortgage rates as well. The average 30-year fixed mortgage rate declined to 7.2% from close to 8% at the end of October.

In contrast to equity and bond indices, the Bloomberg Commodity index had a negative return for November. The main drag on the index return was the 10% decline in the energy sub-index. Both oil and natural gas prices dropped sharply during the month due to increasing inventories and concerns about slowing demand, particularly from China. The price of West Texas Intermediate crude oil declined to about $76 per barrel at the end of November from $83 at the end of October. The livestock sub-index also posted a negative return with inventory higher and demand weakening.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

Even though central banks continue to comment that the fight against high inflation is not over, it is likely the rate hiking cycle has peaked due to signs of a downward trajectory in inflation for goods, services, and housing. However, it is also likely interest rates will remain higher than consumers, businesses, and investors have been accustomed to over most of the past decade. The combination of higher prices, higher financing costs, and tighter lending conditions for a sustained period could be a headwind for consumer and business activity as well as a pressure on corporate profits. Therefore, financial markets are likely to continue to be volatile in reaction to new data reports. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality.

We retain our neutral weight position recommendation for developed market equities and our underweight for emerging markets equities. Since bond yields are more attractive than they have been in many years, we encourage investors to revisit fixed income allocations. Our fixed income recommendation is for an equal weight position relative to long-term targets. We favor shorter maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: