November 07, 2023

The key factor in financial markets continues to be bond yields. Yields rose again during October with longer-term yields rising the most. The 10-year U.S. Treasury bond briefly touched 5% in October, a 16-year high. Yields rose outside the U.S. as well. The 10-year government bond yield in Japan rose to a 10-year high, the 10-year German government bond yield hit a 12-year high, and the United Kingdom 10-year government bond yield reached the highest level since 2008. Resilient macroeconomic data, especially strong labor market and retail sales data, sticky inflation, and still hawkish central bank comments are contributing to the increasing rates by fueling the “higher for longer” view. In addition, unusually heavy issuance of new Treasury bonds to fund the U.S. budget deficit is playing a part due to supply/demand dynamics. Rising yields mean lower bond prices, which translated into negative returns for most fixed income sectors. Higher yields increase the discount rate applied when valuing future cash flows, thereby lowering stock valuations. Higher yields also increase the incremental cost of financing, increase expenses, tighten financial conditions, and decrease the competitiveness of stocks for income oriented investors. All these are negative for stock prices and equity market index returns in October reflect the repricing of stocks in light of changing conditions. Increasing yields also contribute to a higher valuation for the U.S. dollar which hurts the competitiveness of U.S. exports and lowers returns from foreign investments.

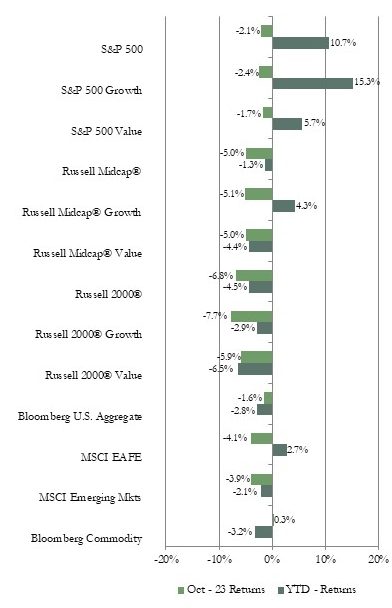

Market Indices – October 2023

U.S. equity market index returns were negative for October. Of note is that the S&P 500, Dow Jones Industrial Average, and Nasdaq indices each fell into correction territory, meaning that the indices were down at least 10% from their recent peaks in the summer. Rising bond yields were a factor, but mixed earnings reports hurt as well. The S&P 500 index outperformed the Russell Midcap index and the Russell 2000 index of small-capitalization (cap) stocks. Value outperformed growth in each of those three indices. In general, defensive sectors such as utilities and consumer staples had the better returns in each index. However, sector returns varied by market cap. For example, energy had the second best return in the Russell Midcap index but was the worst performing sector in the S&P 500.

U.S. equity market index returns were negative for October. Of note is that the S&P 500, Dow Jones Industrial Average, and Nasdaq indices each fell into correction territory, meaning that the indices were down at least 10% from their recent peaks in the summer. Rising bond yields were a factor, but mixed earnings reports hurt as well. The S&P 500 index outperformed the Russell Midcap index and the Russell 2000 index of small-capitalization (cap) stocks. Value outperformed growth in each of those three indices. In general, defensive sectors such as utilities and consumer staples had the better returns in each index. However, sector returns varied by market cap. For example, energy had the second best return in the Russell Midcap index but was the worst performing sector in the S&P 500.

The MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) posted a negative return for October. Returns for both indices were better on a local currency basis since the dollar advanced during the period. The currency impact was larger for the EAFE than the EM index. In contrast to results in the U.S. equity market, the growth index outperformed the value index in both the EAFE and EM indices. Utilities was the top performing sector in the EAFE index and healthcare had the top return in the EM. Real estate was the worst performing sector in both indices reflecting higher rates in the EAFE countries and property sector debt problems in China. On a geographical basis, among developed international markets, the euro area had the smallest decline while the Pacific ex Japan region had the largest negative return. Emerging Europe was the top performing region among emerging markets due to a rebound in Poland. Turkey was the worst performing EM country reflecting a large interest rate hike. The China index continued its weak streak with a -4% return.

U.S. bond market sector returns were mostly negative for October. Only the shortest maturity bond indices posted small positive returns. Longer-term bond indices had the worst returns as yields rose. The yield curve remains inverted, but the level of inversion has declined. The 3-month Treasury bill yield was 5.6% at the end of October compared to the 2-year Treasury bond yield of 5.1% and the 10-year Treasury bond yield of 4.9%. The rise in bond yields has pushed mortgage rates up. The average 30-year fixed mortgage rate is now close to 8%, the highest in two decades. Existing home sales fell to a 13-year low in the latest report hurt by tight supply and high mortgage rates.

The Bloomberg Commodity index had a small positive return of less than half of one percent for October. Sub-index results were mixed. The precious metals index had the largest gain of over 6% driven by the advance in the price of gold on safe haven fears after the breakout of war between Israel and Hamas. The grains and broader agriculture sub-indices each had a positive return. The petroleum, energy, and industrial metals sub-indices each posted a negative return reflecting worries about slowing future demand. The price of West Texas Intermediate crude oil dropped to about $83 per barrel at the end of October from $91 at the end of September.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

The economy has been resilient with gross domestic product, retail sales, and corporate profit reports coming in better than expected, the labor market remaining tight, and inflation cooling. Central banks continue to comment that the fight against high inflation is not over. Therefore, even though we may be near or at the end of this rate hiking cycle, it is likely interest rates will remain higher than consumers, businesses, and investors have been accustomed to over most of the past decade. The combination of higher prices, higher financing costs, and tighter lending conditions for a sustained period could be a headwind for consumer and business activity as well as a pressure on corporate profits. Therefore, financial markets are likely to continue to be volatile in reaction to new data reports. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality.

We retain our neutral weight position recommendation for developed market equities and our underweight for emerging markets equities. Since bond yields are more attractive than they have been in many years, we encourage investors to revisit fixed income allocations. Our fixed income recommendation is for an equal weight position relative to long-term targets. We favor shorter maturity bonds due to the inverted yield curve. We recommend an underweight allocation to hedge funds. Within the hedge fund sector our view is that the opportunity set for distressed investing strategies may be improving as interest rates are at multi-year highs and credit conditions are tightening.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: