October 06, 2023

For the second month, the “higher for longer” interest rate theme dominated financial markets resulting in negative returns for broad global equity, bond, and commodity indices. U.S. Treasury bond yields rose to the highest level in over 15 years. In August, the increase in bond yields (and decline in prices) was fueled by data reports that showed economic resiliency. In September, many of the data reports continued to show better than expected economic activity, particularly the labor market and retail sales. However, the main driver for the rise in bond yields was the new projections from the Federal Reserve Open Market Committee (Fed) that detailed the Fed’s expectations for higher rates for longer. The Fed’s new projections show an expected policy interest rate at the end of 2024 of 5.1%, which is up from the forecast of 4.6% in the June meeting and 4.3% in the March meeting. The new projection implies only two interest rate cuts in 2024, down from four in previous forecasts. Similarly, the new projection for the policy interest rate at the end of 2025 was 3.9%, which is above the 3.4% projected in June. The higher for longer theme is not unique to the U.S. Several European Central Bank officials commented that their policy may need to stay at “restrictive” levels for some time to combat inflation. Yields rose outside the U.S. as well. The yield on the 10-year Japanese government bond rose to the highest level in over a decade and the 10-year German Bund yield reached a 12-year high. Higher bond yields make stocks look more expensive when discounting future earnings, which drove equity prices lower. The rise in bond yields also drove the dollar higher and gold lower. Oil prices continued to rise sharply due to production cuts.

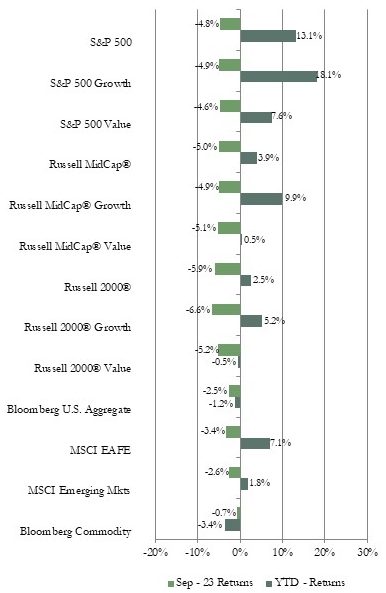

Market Indices – September 2023

Recent reports on inflation rates in the U.S. were mixed. The consumer price index (CPI) rose to 3.7% year-over-year from 3.2% in the prior month. Energy prices were a significant contributor to the increase. For example, the price of gasoline was up 10.6% over the prior month on production cuts and a bump-up in refinery margins. The core CPI rate was 4.3% year-over-year down from 4.7% in the prior month. The Fed’s preferred measure, the personal consumption expenditures index (PCE) was up less than expected at 3.9% annual growth, which was the slowest rate since 2020. The eurozone CPI also increased at the lowest rate in two years with an increase of 4.3%.

Recent reports on inflation rates in the U.S. were mixed. The consumer price index (CPI) rose to 3.7% year-over-year from 3.2% in the prior month. Energy prices were a significant contributor to the increase. For example, the price of gasoline was up 10.6% over the prior month on production cuts and a bump-up in refinery margins. The core CPI rate was 4.3% year-over-year down from 4.7% in the prior month. The Fed’s preferred measure, the personal consumption expenditures index (PCE) was up less than expected at 3.9% annual growth, which was the slowest rate since 2020. The eurozone CPI also increased at the lowest rate in two years with an increase of 4.3%.

Other key news in September was the better than expected economic reports from China that some analysts point to as signs the Chinese economy may be starting to stabilize. Industrial production, retail sales, and lending activity were above forecasts and the unemployment rate declined. Also, exports, while down 9%, were also better than expected. The People’s Bank of China cut reserve ratio requirements by a quarter of a percentage point to inject more liquidity into the financial system.

For the second consecutive month, each major U.S. equity market index posted a negative return in September. The S&P 500 index declined less than the Russell MidCap index which declined less than the Russell 2000 index of small-capitalization (cap) stocks. There was little difference between the returns for the growth and value indices for the S&P 500 index and the Russell MidCap. However, the value index declined less than the growth index in the Russell 2000 index. Energy was the top performing sector in each of the three market-cap indices. The real estate sector had the worst return in S&P 500 index while the communications sector was the performance laggard in both the Russell MidCap and Russell 2000 index.

Both the MSCI EAFE index of developed international equities and the MSCI Emerging Markets index (EM) outperformed the U.S. equity market with the EM index outperforming the developed markets. Both the EAFE and EM indices had a negative return for September on a U.S. dollar basis. Both indices had a better return, though still negative, on a local currency basis since the dollar advanced during the period. The value index outperformed the growth index by a wide margin in both the EAFE and EM indices. Energy was the top performing sector in both indices. Information technology had the lowest sector return in the EAFE and the real estate sector was the laggard in the EM. On a geographical basis, the United Kingdom and Pacific region countries had the best returns while European countries had the largest negative returns due to rising interest rates and signs of slower economic growth. Among emerging markets, Turkey, Philippines, and India had the best performance each with a positive return. Poland with a double-digit negative return was the performance laggard. The central bank in Poland made a surprise cut to policy interest rates citing slowing growth in economic activity.

U.S. bond market sector returns were negative for September. Yields moved up during the month (and prices went lower) reflecting stronger than expected economic data and the adjusted projections from the Fed that pointed to higher for longer interest rates. The yield on both 2-year and 10-year Treasury bonds hit 15-year highs. The 2-year yield got as high as 5.2% and the 10-year reached 4.6%. The yield curve remains very steeply inverted with the 3-month Treasury bill yield at 5.6%. A high volume of new issuance of government and corporate bonds also pushed yields up.

The Bloomberg Commodity index had a small negative return for the month. Sub-index returns were mixed. The petroleum sub-index was the performance outlier with a gain of almost 8%. Crude oil prices rose sharply as inventory levels continue to shrink due to production cuts by Saudi Arabia and Russia. The price of West Texas Intermediate crude oil rose about 9% for the month and hit $90 per barrel for the first time in 2023. The industrials metal sub-index posted a positive return of over 1% helped by a strong gain for aluminum. The livestock index also had a small gain. The grains sub-index was down over 5% on good harvest results and the precious metals sub-index declined on lower prices for both gold and silver. The demand for gold softened as U.S. interest rate rose and economic activity continued to show resilience. Vogel Consulting, LLC (Vogel) Tactical Recommendations

The economy has been resilient with gross domestic product and corporate profit reports coming in better than expected, the labor market remaining tight, and inflation cooling. However, inflationary pressures persist, such as rising oil prices and demand for higher wages as evidenced by the current auto workers strike, so it is likely interest rates will remain higher than consumers, businesses, and investors have been accustomed to over most of the past decade. The combination of higher prices, higher financing costs, and tighter lending conditions for a sustained period could be a headwind for consumer and business activity as well as a pressure on corporate profits. Therefore, financial markets are likely to continue to be volatile in reaction to new data reports. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality.

We retain our neutral weight position recommendation for developed market equities. We have moved our recommendation for emerging markets equities to underweight due to the strengthening dollar and challenges in the Chinese economy. Since bond yields are more attractive than they have been in many years, we encourage investors to revisit fixed income allocations. Our fixed income recommendation is for an equal weight position relative to long-term targets. We favor shorter maturity bonds due to the steeply inverted yield curve. We recommend an underweight allocation to hedge funds. Within the hedge fund sector our view is that the opportunity set for distressed investing strategies may be improving as interest rates are at multi-year highs and credit conditions are tightening.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: