October 08, 2025

Labor market data is always a focus for financial market participants and often drives market moves. However, jobs data agruably was the only data that mattered in September since the weakening trends in all labor market data essentially ensured a rate cut by the Federal Reserve (Fed) at its mid-month meeting. For example, job openings dipped to 7.18 million and there are now more job seekers than job openings for the first time since April 2021. Only 22,000 nonfarm jobs were added in the prior month. The unemployment rate rose to 4.3%, the highest level since 2021. As expected, the Fed did lower its fed funds rate by a quarter of a percentage point to a target rate of 4.00% – 4.25%. Its dot plot of expectations for rates in the future pointed to two more quarter point cuts in 2025. Markets rallied in anticipation of the cut and the rally continued through the end of the month despite sticky inflation data, such as the consumer price index (CPI) rising to 2.9% from the prior month, the highest level since January. Major U.S. equity indices hit several new record highs, bond prices rose, and gold also hit new highs in September.

Labor market data is always a focus for financial market participants and often drives market moves. However, jobs data agruably was the only data that mattered in September since the weakening trends in all labor market data essentially ensured a rate cut by the Federal Reserve (Fed) at its mid-month meeting. For example, job openings dipped to 7.18 million and there are now more job seekers than job openings for the first time since April 2021. Only 22,000 nonfarm jobs were added in the prior month. The unemployment rate rose to 4.3%, the highest level since 2021. As expected, the Fed did lower its fed funds rate by a quarter of a percentage point to a target rate of 4.00% – 4.25%. Its dot plot of expectations for rates in the future pointed to two more quarter point cuts in 2025. Markets rallied in anticipation of the cut and the rally continued through the end of the month despite sticky inflation data, such as the consumer price index (CPI) rising to 2.9% from the prior month, the highest level since January. Major U.S. equity indices hit several new record highs, bond prices rose, and gold also hit new highs in September.

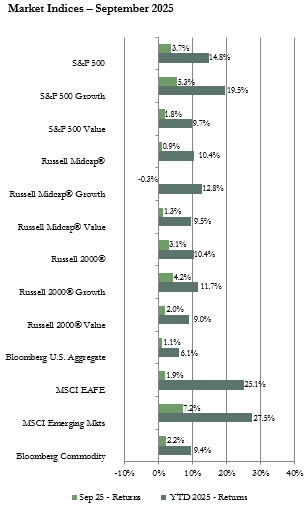

In the U.S. equity market, the large-capitalization (cap) index had the top return driven higher by the interest rate cut anticipation and also by enthusiasm for artificial intelligence (AI) related business stories. The rally did broaden out to extend to the small-cap sector with the return for the Russell 2000 index just marginally behind the return for the S&P 500. Small-cap stocks tend to be more interest rate sensitive than larger-cap stocks so the Fed rate cut provided a significant boost in confidence for the small-cap sector. The mid-cap asset class lagged with the Russell MidCap index posting a return of under 1% due to weakness in the industrial, consumer discretionary, and materials sectors. Consumer staples was weak in each market cap segment. Communications, information technology, and utilities were the best performing sectors in each market cap segment.

Returns for foreign equity indices were positive in September also. The MSCI EAFE index of developed international equities had a moderate positive return but lagged the return for the S&P 500. In contrast, the MSCI Emerging Markets (EM) index posted a return of over 7% that outperformed U.S. and developed international indices. The impact of currency movements was much more muted than in previous months but did have a slight positive impact on returns for U.S. dollar based investors. The growth index outperformed the value index in both the EAFE and EM. Information technology and industrials were the sector performance leaders in the EAFE reflecting the boom in AI and defense related spending in Europe and Japan. Consumer discretionary and materials had the top sector returns in the EM index. The consumer discretionary sector return was boosted by online commerce companies such as Alibaba that was up 53% on news about increasing spending on AI projects. The materials sector was boosted by high double-digit gains for mining companies reflecting the surge in gold and silver prices. On a geographical basis, among developed international regions, Europe was the performance leader reflecting improving economic growth data and optimism for further growth fueled by fiscal stimulus. In emerging markets, increasing demand for semiconductors for AI projects drove the South Korean and Taiwanese stock indices to top returns. AI enthusiasm also contributed to a strong gain for the China index. The China index had another major boost from robust cash flows into the market by domestic investors since investment alternatives such as cash and property offer paltry return potential in that economy.

U.S. government bond yields moved lower at the short and long-end of the maturity curve due to expectations for, and the actual, interest rate cut by the Fed. Yields for intermediate-term government bonds ended the month essentially flat compared to levels at the start of the month. Yields in other sectors of the U.S. bond market followed suit. Therefore, returns were positive for September in each sector. Long maturity bonds posted the highest returns. Corporate bonds outperformed government bonds. The benchmark 10-year U.S. Treasury bond yield started the month at 4.23% but ended the month at 4.16%. Even with the Fed rate cut, the yield on the 3-month Treasury bill ended the month just above 4%. Currently, Treasury bond yields are over 4% for only maturities under 6-months and maturities of 10-years and over.

The positive return for the Bloomberg Commodity index for September was driven by gains for only three major sub-indices. The sub-indices with gains were industrial metals, precious metals, and petroleum. The agriculture related sub-indices declined for the month. The main story in the commodity sector was the double-digit gains for gold and silver. The precious metals advanced due to the expectation for an interest rate cut by the Fed which caused the dollar to weaken, continued geopolitical issues which drove safe haven buying, and continued strong buying by central banks. Growing industrial demand for the metals, especially for silver, provided an additional boost.

Vogel Consulting, LLC (Vogel) Tactical Recommendations

As is often the case, capital market participants are currently navigating mixed signals. Earnings have been resilient for the most part, AI investment is providing a boost to companies in various industries and is driving expectations for increased productivity across the economy, and businesses and consumers are looking forward to the benefits of declining interest rates. However, questions remain about the flow through of tariff impacts, the labor market is clearly slowing which could dampen spending and investment, and asset prices are high in many sectors particularly large-cap technology, communications, and other AI related stocks. Therefore, our view continues to be that diversification across regions and asset classes is likely to be beneficial as global economies and markets navigate potentially significant changes to policies as well as business and consumer reactions to those policies. Policy makers and investors will be closely watching data for clues to the outlook for economic activity and the impact on corporate earnings so we expect periods of volatility as markets react to cross currents in the news.

Our current recommendations are for a neutral weight position in U.S. and international developed equities with an underweight to emerging markets equities. Our neutral view on growth relative to value remains in place as we prefer to have exposure to sectors benefiting from longer-term secular growth trends along with some exposure to cyclicality. Since bond yields are still attractive, we retain our equal weight recommendation for fixed income. We favor short to intermediate maturity bonds. We recommend an underweight allocation to hedge funds. We continue to recommend an overweight to cash reserves to avoid having to sell assets in a down market period to cover spending needs since markets are likely to be volatile throughout the year in reaction to policy, earnings, and economic news.

The statistical information contained in this commentary has been compiled from publicly available sources and is presented to you for your review and for discussion purposes only. The information contained in this commentary represents the opinion of the author(s) as of its date and is subject to change at any time due to market or economic conditions. These comments do not constitute a recommendation to purchase, sell or hold any security, and should not be construed as investment advice or to predict future performance. Past performance does not guarantee future results.

The statistical information contained in this commentary was derived from sources that Vogel Consulting, LLC believes are reliable, and such information has not been independently verified by Vogel. Russell Investment Group is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of the Russell Investment Group. An index is not managed and is unavailable for direct investment.

Print: Download PDF:

Download PDF: